Bushveld: Q2 2020 And H1 2020 Operational Update

Bushveld Minerals Limited (AIM: BMN), the AIM quoted, integrated primary vanadium producer and energy storage provider, with ownership of high-grade assets in South Africa, (“Bushveld”), is pleased to provide an operational update for the three months and six months ending 30 June 2020 (“Q2 2020 and H1 2020”), in respect of Bushveld Vanadium and Bushveld Energy, as well as other corporate activities.

Key Highlights

Bushveld Vanadium Group production for Q2 2020 of 778 mtV (100 per cent basis) was five per cent higher than Q2 2019 (Q2 2019: 742 mtV) through the inclusion of production from the recently acquired Vanchem processing assets.

Group production for H1 2020 of 1,649 mtV (100 per cent basis) was 18 per cent higher than H1 2019 (H1 2019: 1,392 mtV), as a result of the inclusion of the production from the Vanchem processing assets for the full six month period.

Estimated production losses of approximately 380 mtV were directly related to the Covid-19 nationwide lockdown in H1 2020. The production losses are comprised of 300mtV at Vametco and 80mtV at Vanchem.

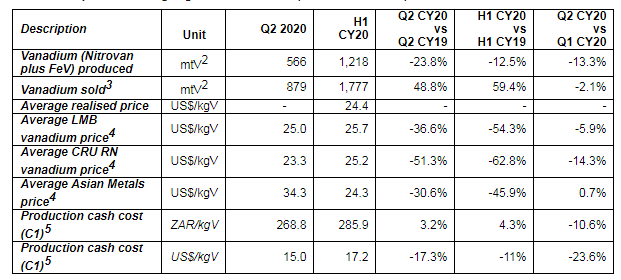

Vametco

Production for Q2 2020 was 566 mtV in the form of Nitrovan and Ferrovanadium. Production was 24 per cent below Q2 2019 production (Q2 2019: 742 mtV), due to the Covid-19 nationwide lockdown and limited workforce flexibility and change in shift patterns in order to comply with Covid-19 protocols.

Production for H1 2020 was 1,218 mtV (100 per cent basis) in the form of Nitrovan and Ferrovanadium. Production was 13 per cent below H1 2019 production (H1 2019: 1,392 mtV) due to the Covid-19 nationwide lockdown.

Q2 2020 production cash cost (C1) of US$15.0/kgV, a 17 per cent decrease relative to Q2 2019 (Q2 2019: US$18.10/kgV), was underpinned by a weaker ZAR:USD rate1.

H1 2020 production cash cost (C1) of US$17.20/kgV, an 11 per cent decrease relative to H1 2019 (H1 2019: US$19.30/kgV), supported by a weaker ZAR:USD rate1

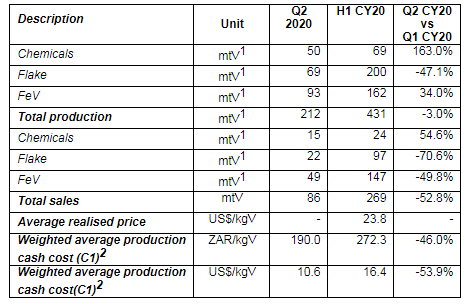

Vanchem

Production for Q2 2020 was 212 mtV, three per cent lower than Q1 2020 production (Q1 2020: 219 mtV) and production for H1 2020 was 431 mtV.

Q2 2020 production cash cost (C1) of US$10.60/kgV, 54 per cent lower than Q1 2020 (Q1 2020: US$22.90/kgV), as a result of record production achieved in May and June, supported by relatively low fixed costs and a weaker ZAR:USD rate1.

Vametco’s production for Q2 2020 was 566 mtV in the form of Nitrovan and Ferrovanadium from magnetite concentrate. Production was 24 per cent below Q2 2019 production (Q2 2019: 742 mtV) and 13 per cent lower than Q1 2020 (Q1 2020: 652 mtV). This decrease in production was due to the nationwide lockdown which resulted in approximately 300mtV of lost production.

Processing activities recommenced during April at a reduced capacity of approximately 50 per cent of production manning levels, in accordance with the Government’s directive.he open pit and processing plant were permitted to return to 100 per cent production levels from 1 May 2020, and Vametco commenced ramp-up and returned to pre-lockdown production levels during the month.

Vametco sold 879 mtV in Q2 2020, of which 598 mtV were final sales to customers. The sales volume includes intercompany sales of 281 mtV, of which 198 mtV have post period end been converted into final sales to customers.

Chinese demand increased in Q2 2020 supported by increased infrastructure spending in line with RMB3.75 trillion (approximately US$500 billion) investment plan to encourage infrastructure investment. This has resulted in price disparities between China and the rest of the world. Robust demand from China is expected for the rest of the year.

The Group has taken advantage of the robust vanadium demand and higher price from China compared to other jurisdictions and increased its Chinese sales. As at the end of H1 2020, Bushveld Minerals supplied 18 per cent of its sales to China, compared to three per cent in H1 2019

Demand from the North American and European steel and aerospace industries declined during the period due to the pandemic and associated plant shutdowns. Demand from the United States and Europe is expected to remain constrained for the rest of the year due to the economic slowdown.

www.ferroalloynet.com