Here’s Why We’re A Bit Worried About Australian Vanadium’s (ASX:AVL) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So, the natural question for Australian Vanadium (ASX:AVL) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we’ll determine its cash runway by comparing its cash burn with its cash reserves.

How Long Is Australian Vanadium’s Cash Runway?

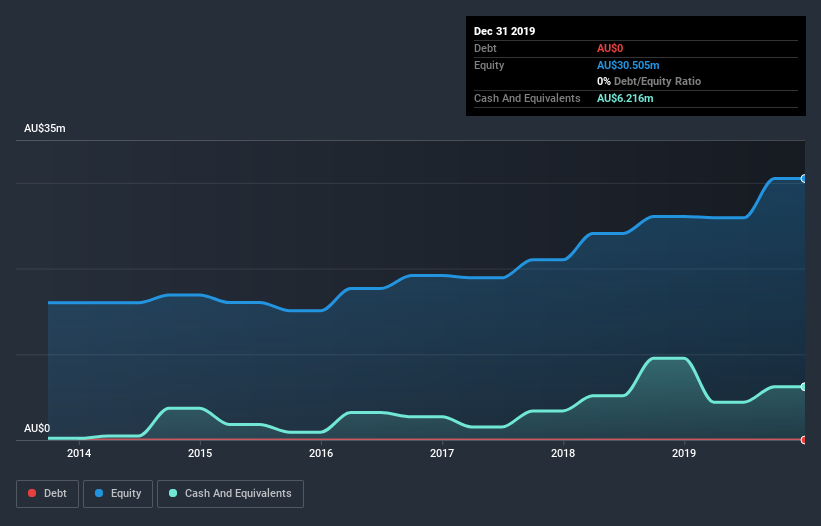

A company’s cash runway is calculated by dividing its cash hoard by its cash burn. When Australian Vanadium last reported its balance sheet in December 2019, it had zero debt and cash worth AU$6.2m. Looking at the last year, the company burnt through AU$9.5m. That means it had a cash runway of around 8 months as of December 2019. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. Depicted below, you can see how its cash holdings have changed over time.

How Is Australian Vanadium’s Cash Burn Changing Over Time?

Because Australian Vanadium isn’t currently generating revenue, we consider it an early-stage business. So while we can’t look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. The skyrocketing cash burn up 151% year on year certainly tests our nerves. It’s fair to say that sort of rate of increase cannot be maintained for very long, without putting pressure on the balance sheet. Australian Vanadium makes us a little nervous due to its lack of substantial operating revenue. So we’d generally prefer stocks from this list of stocks that have analysts forecasting growth.

Can Australian Vanadium Raise More Cash Easily?

Given its cash burn trajectory, Australian Vanadium shareholders should already be thinking about how easy it might be for it to raise further cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company’s cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year’s cash burn.

Australian Vanadium’s cash burn of AU$9.5m is about 34% of its AU$28m market capitalisation. That’s fairly notable cash burn, so if the company had to sell shares to cover the cost of another year’s operations, shareholders would suffer some costly dilution.

Is Australian Vanadium’s Cash Burn A Worry?

Australian Vanadium is not in a great position when it comes to its cash burn situation. While its cash burn relative to its market cap wasn’t too bad, its increasing cash burn does leave us rather nervous. Once we consider the metrics mentioned in this article together, we’re left with very little confidence in the company’s ability to manage its cash burn, and we think it will probably need more money. Separately, we looked at different risks affecting the company and spotted 5 warning signs for Australian Vanadium (of which 2 can’t be ignored!) you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Promoted

If you decide to trade Australian Vanadium, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

www.simplywall.st