High Voltage: here’s all the latest news driving ASX battery metals stocks

Date: Nov 14, 2018

Each week our High Voltage column wraps all the news driving ASX battery metals stocks with exposure to lithium, cobalt, graphite, manganese and vanadium.

>> Scroll down for a table showing the recent performance of 200 ASX battery metal stocks

Industry focus

Could cobalt follow lithium and make a resurgence? Cobalt sales prices –albeit still relatively healthy from all reports — have been in slow decline since peaking early in the year.

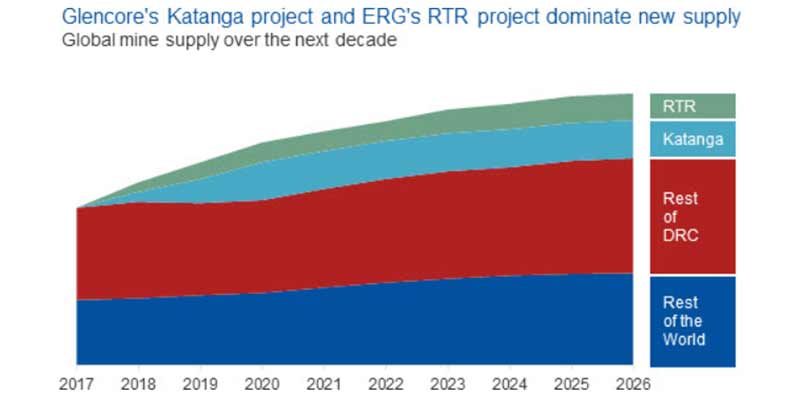

Enter major miner, Glencore, which has cut production at its soon-to-be globally significant Katanga operations in the Democratic Republic of Congo for at least 7 months.

This could stabilise recent price declines caused by a perception that the current cobalt market is oversupplied, experts say.

Analysts are divided on whether the supply side impacts will be significant or not.

But they do agree that this event could put a floor underneath the price of the battery metal and even catalyse a new period of growth – with cobalt stocks set to benefit.

And Australian hard rock lithium projects received a boost from major miner Albemarle (NYSE:ALB) in general this week.

The global miner told investors that “a significant acceleration in demand for lithium hydroxide” from battery makers — at the expense of the industry standard lithium carbonate — prompted it to favour developments in Australia and hit pause on expansions at its Chilean brine operations.

This is because it is often cheaper to produce lithium hydroxide from hard rock.

Vanadium remains of the year’s best performing metals measured by its spot price, which has risen above $US37 per pound — up from $US5 in early 2017.

While the spot price is “a little too high at the moment” to be sustainable, they are expected to stabilise at about $US30/lb in the short term – far healthier than the $US4 to $US6 range it bounced between from 2009 to early 2017, David Gillam of mining industry consultancy Mastermines says.

But only about 10 per cent of vanadium projects are good enough to become long term operations, Mr Gillam says.

“We are looking for someone that can be the next [major vanadium producer] Bushveld or the next Largo,” he says.

“This means ore grades of around 0.8 per cent to 1.2 per cent for starters.”

But most importantly a project needs operating costs of about $US4/lb of vanadium produced.