Largo Resources Could Survive The Vanadium Collapse

Summary

The price of Vanadium has fallen by almost 80%. Vanadium is Largo’s only product.

Largo has battened down the hatches by paying off its debt. It also has a low-cost mine.

I argue that Vanadium will not return to frothy levels soon.

Largo is still a pretty good long-term play, although the commodity price risk is high.

I have been covering Largo Resources since January 2018. I wrote a bullish article on it here and a somewhat more cautious article later. I have also commented on several other articles. The editors of Seeking Alpha have asked me to update my views on this company.

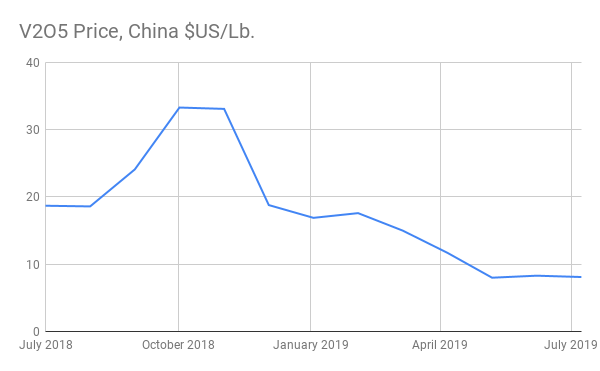

Largo only produces one product, Vanadium (V). The V market has been in a bear market for the past year. Here’s a chart of Vanadium Pentoxide, Largo’s product:

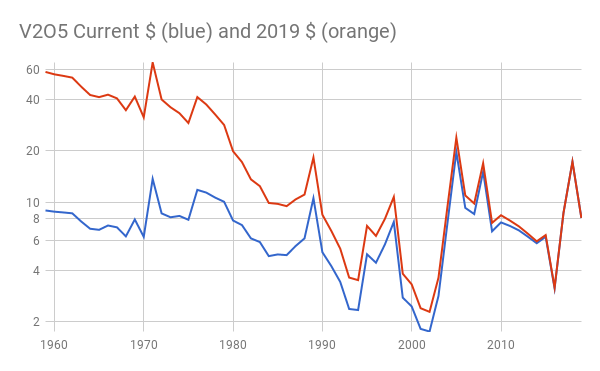

You can see the bear market. It’s important to put this into context though. On a longer term basis, V is still about the average of the last 30 years. Here’s a very long term chart, with data from the US Geological Service (USGS) (note the log scale):

The argument I made for going long V equities, including Largo, in early 2018 had several reasons. Let’s go over them and see where they stand now.

1. Much China V production was (and is still) derived from blast furnace slag. As seaborne iron ore is substituted for high-vanadium local ore (for pollution reasons) this source should decline. This has not yet occurred. According to the USGS, Chinese V production in 2018 was just about the same as 2017. However, I still believe this will happen. The Chinese authorities appear to be quite concerned about air quality, and I believe this will eventually lead to lower V production.

2. China will implement stronger building codes that will lead to more V alloying in rebar. This has happened, but more slowly than I thought. The new standards were passed, but are only being partially enforced. This is typical of how things work in China. In the US if a developer builds a structure below code, he can be sued. In China, it’s up to the (mostly local) governments to decide how strongly to enforce various laws. I expect that this will eventually be enforced, but it may be phased in over years. Of course one major earthquake might change this.

3. V redox flow batteries add an upside to long term V demand. Refer to my prior articles for a discussion of this. At current levels of V pricing, this is a possibility. However, there are several competing technologies for grid-level electrical storage, and the technology is not mature. Additionally, a serious rise in the V price would make this uneconomic. So I’m still not counting on this being a major market factor for years, if ever.

There is another issue that I had not discussed: substitution of V by other alloying metals. This has happened, particularly with niobium. Most of the world’s niobium comes from one company in Brazil. This company, private but with world steel company ownership, has increased capacity. Since V and Nb can substitute in some applications, this is a negative. OTOH, primary V production has only increased marginally, even with the bull market.

The net of all this is that the V market will probably be moderately healthy for the foreseeable future. However, there will not be a renewal of the huge bull market of 2018. So I believe Largo will have to make do with only prices in a range of $8 – $15 per pound.

Can Largo work in this framework? I think it can. Largo management has wisely used the cash flow from the bull market to pay off all its debt. Additionally, Largo’s mine is quite low cost. Operating costs are probably in the $5 – 6 per lb. range. I believe this is the lowest cost pure V mine in the world. Remember though that much V is a byproduct, either of iron ore slag or oil refinery catalyst recycling. The costs of that are very low.

I think Largo will weather the storm. Let’s assume V2O5 prices move back to $12 / lb., as I think they will. Here’s a pro forma income statement for Largo at $12 V and $8 (the current price). Note that I am only drilling down to income pre-tax.

| Lbs. Vd2O5 Produced | 22,050,000 | 22,050,000 |

| Memo: Implied China V2O5 Price | $12.00 | $8.00 |

| Less: Mkting/Trans costs @5% | $13,230,000 | $8,820,000 |

| Revenue | $251,370,000 | $167,580,000 |

| Operating Costs | $116,000,000 | $116,000,000 |

| Memo: Op Cost/lb | $5.26 | $5.26 |

| Operating Profit | $135,370,000 | $51,580,000 |

| SG&A + Other | $26,398,732 | $26,398,732 |

| Finance Costs | $0 | $0 |

| Net Income Before Tax | $108,971,268 | $25,181,268 |

| Number of Shares Diluted | 531,000,000 | 531,000,000 |

| Net Income / Share | $0.21 | $0.05 |

| Current Price | $1.74 | $1.74 |

| Implied P/E | 8.48 | 36.69 |

So if my forecast of $12 works out, Largo is an good investment. If not, not so much. Not mentioned here is the operational risk. So far Largo leadership has managed this quite well. But this could change.

Another risk for V prices is a slowdown in the world construction business. Although V is used in many sectors, construction is by far the largest. This is mostly dependent on the economies of developing Asia, particularly China. I am far from an expert on this. However, I have read a recent UBS report on the world construction industry. It’s main conclusions are that there is going to be a “meaningful” slowdown in global construction over the next year and a half. One can see this in a variety of industrial stock prices, so maybe it will happen. Personally, I think there is too much bearishness about industrial products in general, but these kind of sector calls are not really my bailiwick. So who knows? Maybe readers can give their opinions in the comments.

How I’m Trading It

Keep in mind that this is essentially a commodity price play. I am bullish on V, but I realize that V has to rise for this to work out.

I have a small position long Largo (<1% of my investing capital). I would look to add in two possible situations. One, if the V price starts moving higher. My guess is that the Largo stock price will move right along with it, and maybe even precede it, so this will be a tough buy. Second, if there is a further decline in the stock price with no V price change. This might come due to a poor quarterly earnings report or a sell-side downgrade.

If you do decide to trade it, I recommend trading in the Canadian market. I realize that not everyone has access to this and there is the FX issue, but the liquidity is better.

Disclosure: I am/we are long LGORF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I write my SA articles for educational purposes only. Before you invest, do your own research. Blindly following the advice of others, even someone as brilliant as I, will only lead to ruin.

www.seekingalpha.com