Review Of Vanadium Market In 2019 And Prospect In 2020

www.ferroalloynet.com: At the beginning of 2019, the vanadium market was affected by the high price in 2018, and the starting point of the price was high. According to the analysis of the basic price of vanadium products over the years, the vanadium price at the beginning of 2019 has been a high price, so it is inevitable that the follow-up market price was reduced to a rational price. In addition, the overall downward trend of vanadium market in 2019 is due to the increase of raw material, the supply exceeding the demand, the lack of implementation and inspection of new rebar standards, and the impact of some imported vanadium product resources on the domestic market. The whole vanadium market in 2019 shows a downward trend, and the slight rise in the middle of a short period of time is unable to sustain the market. Until the end of the year, the vanadium market is in a stable situation. As for the cost of V2O5 flake, the current price has not reached the bottom objectively, and the vanadium market will be cautious in 2020.

I. Review of Vanadium Market in 2019

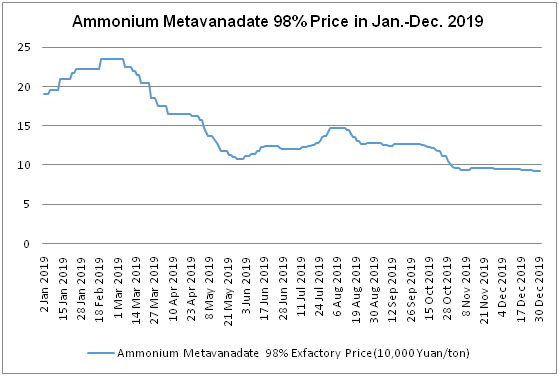

i. Ammonium Metavanadate

1. Ammonium metavanadate market review in the first quarter

In the first quarter, the price of ammonium metavanadate fluctuated with the overall vanadium market, showing a trend of rising first and then falling. At the beginning of January, the market price of ammonium metavanadate was about 190000 yuan / ton. Then, due to the approaching of Spring Festival, the price of downstream alloy was increased due to the stock preparation of steel plants, and the price of ammonium metavanadate was forced to rise. By the beginning of March, the price of ammonium metavanadate reached the highest point of 230000 yuan / ton in 2019. Due to the “empty window period” of downstream demand after the Festival, the price of ammonium metavanadate fell again due to the influence of the price reduction of vanadium alloy and V2O5 flake.

2. Ammonium metavanadate market review in the second quarter

In the second quarter, the market of ammonium metavanadate fluctuated little, but the trend was changeable, and the overall trend was flat-fall-rise. After a fall in March, the price of vanadium temporarily stopped falling in April, and the market price of ammonium metavanadate ran smoothly for nearly a month at about 160000 yuan / ton, then entered a long decline channel in May, and by the end of May, it basically fell to the lowest price of 110000 yuan / ton in the first half of 2019. In June, affected by the improvement of steel plants’ demand, the price of ammonium metavanadate was slightly increased again by the price increase of other vanadium alloys.

3. Ammonium metavanadate market review in the third quarter

In the third quarter, the price of ammonium metavanadate was relatively stable. At the end of July and the beginning of August, there was a slight short-term increase, and then it returned to stable operation between 120000 yuan / ton and 130000 yuan / ton. At this time, the price of ammonium metavanadate was close to the cost line of stone coal vanadium extraction enterprises, but most of the manufacturers still kept low profit production, and the operating rate of ammonium metavanadate had no significant fluctuation.

4. Ammonium metavanadate market review in the fourth quarter

In the fourth quarter, with the recession of vanadium alloy terminal demand, the price of ammonium metavanadate fell steadily, with the main decline occurring in the middle and late October. Then, the price of ammonium metavanadate fluctuated steadily and narrowly until the end of the year. Since November, the price of ammonium metavanadate has fallen below 100000 yuan/ton, which has exceeded the cost line of most stone coal vanadium extraction manufacturers. As a result, stone coal vanadium extraction enterprises in Hunan, Hubei, Shaanxi, Henan and other regions have stopped production. The production of ammonium metavanadate also reached a new low in the fourth quarter after a large-scale shutdown. Until the end of the year, the price of ammonium metavanadate 98% metallurgical grade dropped to about 90000 yuan / ton, 98 chemical grade dropped to 95000-96000 yuan / ton.

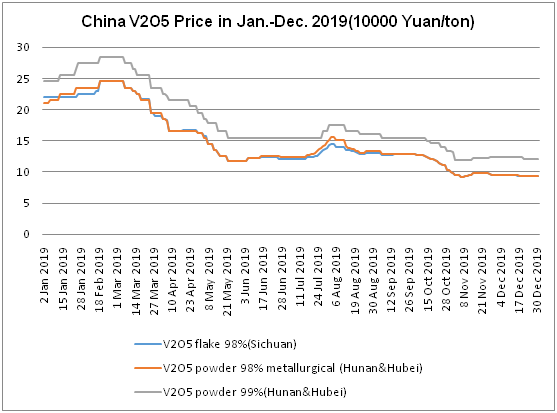

ii. Vanadium Pentoxide

1. V2O5 market review in the first quarter

In the first quarter, the price trend of V2O5 flake also rose first and then fell. At the beginning of the year, the market price of V2O5 flake was about 220,000 yuan / ton. With the increase of steel plant’s purchase of vanadium alloy before the festival, the price of V2O5 flake rose with the increased price of downstream alloy. At the end of February and the beginning of March, V2O5 flake reached the highest price of 250,000 yuan / ton in 2019. After the Spring Festival, the demand of steel plants became weak, and the price of vanadium also fell during this period. By the end of March, the market price of V2O5 flake had dropped to about 190,000 yuan / ton. During this period, the price of metallurgical grade and chemical grade V2O5 powder was also decreasing.

2. V2O5 market review in the second quarter

In the second quarter, the market price of V2O5 flake showed a trend of stabilizing first, then falling and then rising slightly. During this period, the market price of V2O5 flake was greatly affected by the pricing of large factories. In April, the overall price of V2O5 flake was stable at about 160,000-170,000 yuan / ton. As 98% metallurgical grade V2O5 powder was also used for vanadium-nitrogen production, the price was basically parallel to V2O5 flake price. In early June, the price of V2O5 flake was low to about 115,000 yuan / ton, the lowest point in the first half of the year, after that, it slightly increased by about 10000 yuan / ton, and the market price fluctuated in a narrow range of about 120000-130000 yuan / ton. During the period of price decline, the price of high-purity chemical powder vanadium followed a slow trend, and since late May, the price has been stable until the third quarter.

3. V2O5 market review in the third quarter

In July, the V2O5 flake market benefited from the rise of the downstream alloy price, and the price trend slightly increased. At the end of July, the price of V2O5 flake reached a high point of 140,000 yuan / ton in the second half of the year, while the short-term high price of V2O5 flake returned to 130,000 yuan / ton quickly, showing a weak trend until the fourth quarter.

4. V2O5 market review in the fourth quarter

In the middle and late October, the market price of V2O5 flake fell in the last wave of the year. The market price dropped rapidly from 130,000 yuan / ton at the beginning of October to 92,000 yuan / ton at the beginning of November. Due to the firm quotation of large factories and the fast consumption of low price V2O5 flake, the price of V2O5 flake in bulk market quickly returned to the quotation of large factories. The price of V2O5 flake remained at 93,000-96,000 yuan / ton until the end of the year. So far, the market price of V2O5 flake is still far away from the cost of manufacturer of vanadium extraction from slags.

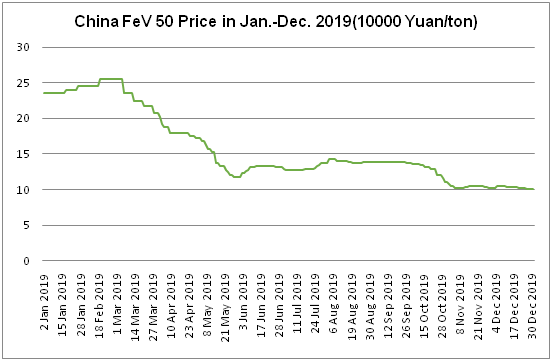

iii. Ferrovanadium

1. FeV market review in the first quarter

In the first quarter, the market price of ferrovanadium started with 220,000 yuan / ton, and Pangang insisted on the quotation of 250,000 yuan / ton. With the procurement of steel plants before the festival, the market price of ferrovanadium was rising due to the demand of vanadium alloy. At the beginning of March, the market price of ferrovanadium reached a high level of 240,000-250,000 yuan / ton in 2019. From March, the market of ferrovanadium was in a stalemate wait-and-see period after the festival. Affected by the market performance of reduced inquiry and poor transaction, the price began to fall for a long time and lasted until the end of May.

2. FeV market review in the second quarter

In the second quarter, the market price of ferrovanadium continued the trend of the first quarter and fell under pressure. At the end of May, the market price dropped to about 120,000 yuan / ton and briefly touched the bottom. Then, the price slightly increased to about 10000 yuan / ton and temporarily stabilized to 130,000 yuan / ton, entering the third quarter under a stable and weak situation.

3. FeV market review in the third quarter

In the third quarter, the market price of ferrovanadium kept stable at about 130,000-140,000 yuan / ton. In 2019, the market of ferrovanadium was not running well, the supply was sufficient, and the purchase from special steel enterprises with small profits was reduced, which led to the supply exceeding demand situation of ferrovanadium market in the year, and the price of ferrovanadium was also relatively passive. In the third quarter, although the price of V2O5 flake or vanadium-nitrogen alloy fluctuated, the market price of ferrovanadium remained stable in a relatively low state. If the price of ferrovanadium was low, it lost money, and it was very difficult to rise.

4. FeV market review in the fourth quarter

Influenced by the V2O5 flake price adjustment of large-scale vanadium factories, the price of ferrovanadium began to decline at the beginning of the fourth quarter, fell from the market price of 130,000 yuan / ton to about 100,000 yuan / ton in November, and then it was stable. During the period of price decline, the price in bulk market was even lower than 100,000 yuan / ton. However, with the gradual stability of the price of V2O5 flake, the price of ferrovanadium began to stabilize at about 100,000 yuan / ton until the end of the year.

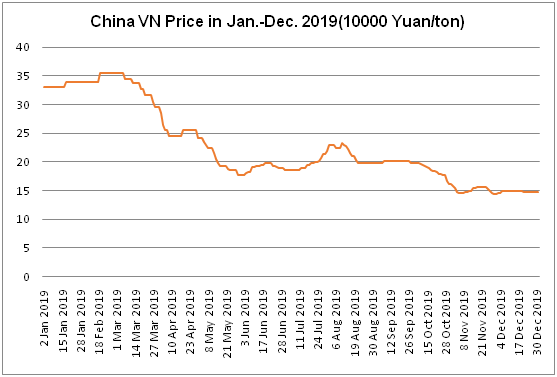

iv. Vanadium-nitrogen Alloy

1. VN alloy market review in the first quarter

In the first quarter, the price of VN alloy continued the trend of high-level operation at the end of 2018. Although it was at a high level, it coincided with the upsurge of “stock up before the festival”. Steel mills started purchasing near the Spring Festival. The price of VN alloy increased slowly from January to February, at the end of February, it rose to the highest price of about 350,000 yuan / ton in 2019. After the festival in March, the purchase volume of steel mills with sufficient stock before the festival decreased sharply compared with that in February. The stalemate in a period of time causes the downstream alloy stocks increased, which eventually led to the price drop in March, and the price dropped to about 250,000 yuan / ton by the end of March.

2. VN alloy market review in the second quarter

In the second quarter, vanadium-nitrogen alloy continued the decline in the first quarter. In late April, it rebounded slightly by about 10000 yuan / ton and then continued to fall. By the end of May, the market price of vanadium-nitrogen alloy fell to the lowest point in the first half of 2019, about 17000-18000 yuan / ton. In June, VN alloy increased slightly again in order to face the quality inspection in July, small steel mills with less vanadium consumed came out to purchase, achieving a short-term demand climax, and the price rose to about 190,000 yuan / ton in late June.

3. VN alloy market review in the third quarter

In August, the price of VN alloy surged slightly again, but it kept for a short time, reaching the highest price in the second half of the year at about 230,000 yuan / ton, and then it was stable and weak in operation. From late August to early October, the price of VN alloy was relatively stable, and the market price fluctuated in a narrow range at about 200,000 yuan / ton.

4. VN alloy market review in the fourth quarter

In late October, affected by the price reduction of V2O5 flake, vanadium-nitrogen alloy market continued to collapse. In addition, after winter, the steel market was sluggish, and the purchase volume of steel plants was reduced. In the second half of the year, the production capacity of V2O5 flake was also fully released. The state of market supply exceeding demand was obvious. By the beginning of November, the market price of vanadium-nitrogen alloy fell to the lowest point of about 140,000 yuan / ton in 2019. With the tight supply of low price V2O5 flake in bulk market, the price of vanadium-nitrogen alloy has been adjusted back to 145000-150000 yuan / ton, then running steadily until the end of the year. Although facing the stock up before the Spring Festival, the purchase volume of the steel plant is also considerable, but the vanadium-nitrogen alloy is difficult to rush higher under the larger supply.

II. Bidding Situation of Steel Mills

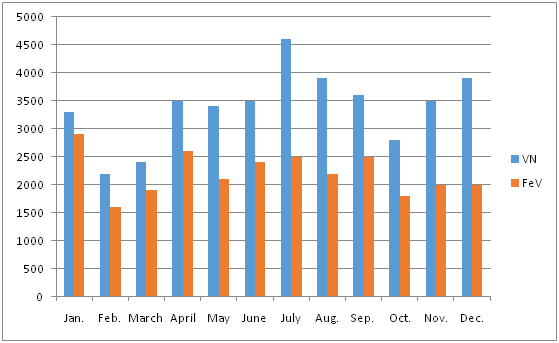

i. Total Bidding Volume of FeV and VN Alloy in 2019(unit: ton)

It can be seen from the above data that in 2019, the purchase volume of VN alloy by steel mills is the largest in the middle of the year, while the purchase volume from January to March was at a low level. This phenomenon is mainly due to the high price of vanadium at the beginning of the year. Compared with the low price imported FeNb, the price is not dominant. After the high price in 2018, many steel plants have mature technology of replacing vanadium with niobium; FeNb can be used flexibly in steel plants when vanadium price is high. And after the price drop from March to May, the price of VN alloy dropped to about 200,000 yuan / ton, which was equivalent to the market price of ferroniobium. Considering the application performance, the steel plant increased the purchase volume of FeV and VN, while the decrease of purchase volume after winter had a basic impact on the demand side of steel. The increase in purchasing volume in December mainly benefited from the upsurge of stock up before the festival.

Looking at the annual purchase volume, it can be seen that the seasonal fluctuation of the purchase volume of ferrovanadium is not as large as that of vanadium-nitrogen alloy. Therefore, it can be judged that the demand side of ferrovanadium is in a low stable state. Once the supply increases, it will be difficult to consume. The demand volume of VN alloy is greatly affected by the modulation of ferroniobium and the price fluctuation of rebar.

ii. Bidding Average Price of FeV and VN Alloy in 2019(unit: 10000 Yuan/ton)

From the figures, in 2019, the prices of FeV and VN alloy purchased by the steel plant fluctuated with the market. In January, the average price of FeV and VN alloy was about 220,000 yuan / ton and 323,000 yuan / ton, respectively. In February, affected by the stock preparation before the festival, the price of steel bidding showed signs of rising, and the price of steel bidding also reached the highest level in the year. The price of FeV and VN alloy was 250,000 yuan / ton and 359,000 yuan / ton, respectively, increased about 30000-40000 yuan / ton compared with February. In May, affected by the increase of supply and the downward channel of vanadium price, the steel plants push the purchasing price. In May, the steel plant’s purchase price reached the lowest level in the first half of the year. From June to August, the vanadium market fluctuated upward, and the steel bidding price of ferrovanadium and vanadium-nitrogen alloy also showed a slight upward trend. In autumn and winter, the steel market was operating at a low level, and the price of vanadium market fell under the condition of oversupply. Although steel plants faced with stock up before the end of December, the average price of ferrovanadium and vanadium-nitrogen alloy was only slightly higher than that in November.

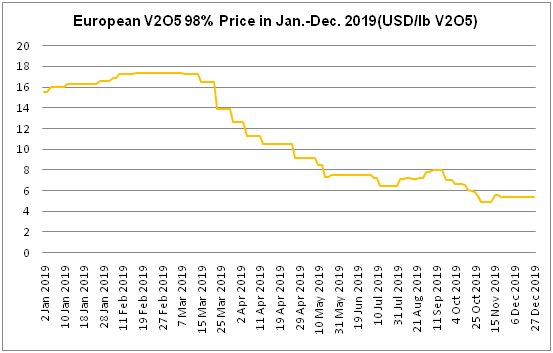

III. Review of International Market Price

From the figures, it can be seen that in 2019 the price trend of international vanadium market is almost parallel with that of domestic market. However, due to the relatively single European market compared with domestic market, the market volatility is relatively slow, consistent with domestic market; the European vanadium market started to run at a high level at the beginning of the year, and then rose with the influence of Chinese market. The time point when domestic vanadium price started to enter the decline channel in the first half of the year was in the beginning of March, but the international market slowed to fall in the late of March. In the second half of this year, the weak low price of vanadium in the European market started to show a certain difference with that in China, and continued to exist until the end of this year, which is also the main reason why China began to import vanadium resources in the second half of 2019.

IV. Review of International Market Imports and Exports

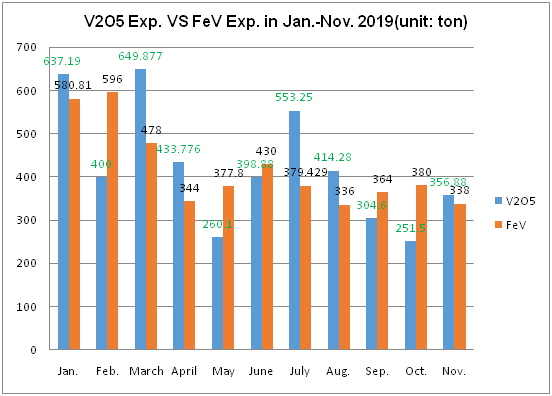

1. Review of exports of vanadium products

According to the export data in 2019, the export volume of China vanadium products is basically parallel to the price trend of European market. The export volume in the first half of the year was generally higher than that in the second half of the year. The main reason for the downward trend of export volume from March to May was the price dropped, which led to careful purchasing at the demand side. The export volume in the second half of the year was flat, which showed a slight downward trend until the end of the year. The main reasons were as follows: Since August, the price of vanadium in the international market had been lower than that in China. Only a few major domestic factory directors have maintained the export market, and the rest of the exporters have basically stopped exporting.

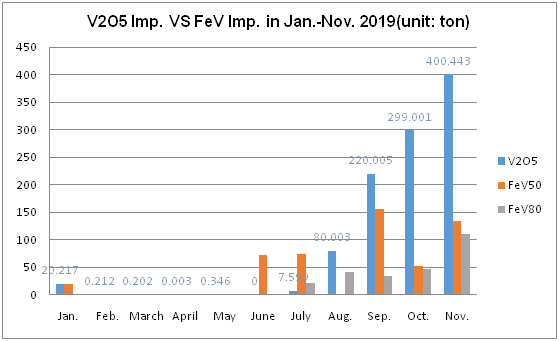

2. Review of imports of vanadium products

The import volume of vanadium products in the first half and the second half of 2019 was obvious. In the first half of 2019, there was almost no import volume of FeV and V2O5. In June, some FeV imports entered the Chinese market, while the real significant price difference between the international market and the domestic market was in August, so the importers began to order in August. From September to November, a large number of imported vanadium products began to arrive at the port. Due to the customs data delayed, the import data in December has not been updated temporarily, but according to FerroAlloyNet, there are still a certain amount of imported FeV and V2O5 arriving at the port in December. Russia’s EVRAZ also signed an exclusive sales agreement with Chinese traders, and the subsequent Russian FeV will continue to be exported to China.

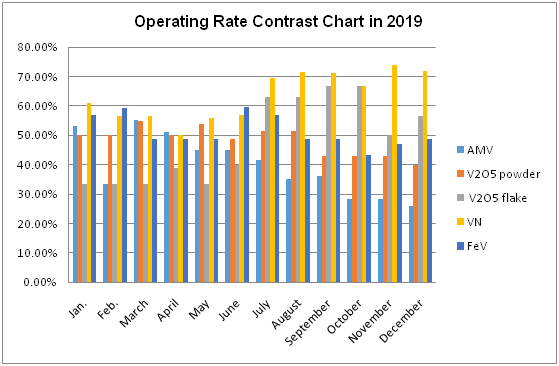

V. Operation Rate in 2019

According to the figures, the fluctuation of operation rate of vanadium series products in 2019 was different. The operation rate of vanadium pentoxide flake and vanadium-nitrogen alloy showed an upward trend throughout the year, while the operating rates of ammonium metavanadate and vanadium pentoxide powder and ferrovamadium show a downward trend, which was greatly affected by price fluctuation and downstream demand. First of all, ammonium metavanadate operated at a low level in the second half of the year. Stone coal vanadium extraction enterprises and enterprises using slag were unable to bear the high cost and stopped production. After winter, some enterprises shut down due to low temperature, and some vanadium powder enterprises shut down for the same reason. The other part of vanadium powder enterprises shut down and production reduction was directly affected by the shut down and production reduction of ammonium metavanadate. The decrease of FeV operation rate is mainly due to the decrease of steel plant procurement. When supply exceeded demand, small ferrovanadium plants have to compete with large domestic enterprises such as Pangang and ChengSteel. The main reason for the production reduction of ferrovanadium plants was the cost inversion. Therefore, it can be seen that the increase of V2O5 flake production in 2019 mostly flowed into the vanadium-nitrogen plants, which is also the main reason for the same increase in the operating rate of vanadium-nitrogen alloy enterprises.

VI. Prediction and Analysis

i. Price

The vanadium market in 2019 can be seen as the adjustment period after the “high fever” in 2018. The market price fell from the beginning of the year to the end of the year. In this period, downstream manufacturers and high-cost raw material manufacturers suffered a lot. By the end of 2019, although the price of vanadium in the market is low, the V2O5 flake price of 93000-96000 yuan / ton was still far away from the cost price of large enterprises that used steel slag as raw materials. According to the cost of steel slag vanadium extraction of 60000 yuan / ton, large V2O5 flake enterprises still have a profit space of 30000 yuan / ton. Looking back at the price trend of vanadium in recent years, the current price is still not a safe bottom price. The pricing of large vanadium plants in the follow-up market still greatly affects the trend of vanadium price. It is estimated that the trend of vanadium price will be weak from the current price in 2020. It is possible that the market price of V2O5 flake will fall below 90000 yuan / ton, and the high price is expected to be difficult to exceed 120000 yuan / ton; the low market price of ferrovanadium is expected to be about 90000 yuan / ton, the high price is expected to be within 130000 yuan / ton; and the price of vanadium-nitrogen alloy is expected to fluctuate within 120000-180000 yuan / ton.

ii. Supply and Demand

The sharp increase in the supply of vanadium in 2019 is also the result of the sharp increase in the price of vanadium in 2018. High profits attract the raw material manufacturers to expand production and increase production, which leads to the oversupply of vanadium market in 2019, resulting in the price drop. As the main production increase occurs in the large vanadium plants, and the current price is far from the cost of large plants, it is less likely that the output will fall in 2019 due to price factors. Some steel plants are still on the way of slag blowing and vanadium extraction, and the output of vanadium extraction from stone coal is expected to remain low in 2019. Some enterprises that are still insisting on production will also face the possibility of production suspension and production reduction in the future. However, the vanadium extraction enterprises affected by the price are only limited to the production of ordinary grade ammonium metavanadate and powder vanadium enterprises. Some manufacturers can still expand their living space by processing high-purity products and extending the industrial chain. Therefore, the reduction of vanadium extraction from stone coal has little impact on the market price. In terms of demand, vanadium batteries are still difficult to realize industrialization. It is predicted that there will not be a large demand for vanadium market in 2020. In terms of steel market, it is judged that the operation will be normal and the demand will be stable. It is difficult to improve the situation that the supply exceeds the demand of vanadium market in 2020. Therefore, it is predicted that vanadium price will continue to explore the bottom space in 2020, and the annual price will fluctuate slightly.

www.ferroalloynet.com