The Vanadium Production From Four Global Vanadium Producers In Q4 2021 And Full Year Of 2021

www.ferroalloynet.com: In 2021, the overall vanadium production in the four large vanadium producers are increasing but Bushveld and Largo Resources impacted by challenges in international logistics channels arising from COVID-19, the unrest in South Africa and disruptions at local ports in July and August as well as the heavy rains in Brazil.

|

Company |

Location |

Products |

2018 |

2019 |

2020 |

2021 |

|

Glencore |

South Africa |

V2O5 |

9162.567 |

9162.5 |

8845 |

9298.75 |

|

Evraz |

Russia |

Vanadium Slag (Gross production) |

17052 |

18380 |

19533 |

20058 |

|

Seles of Vanadium final products(FeV) |

12353 |

12883 |

12534 |

13288 |

||

|

Bushveld |

South Africa |

V2O5 Flake, AMV,FeV, MVO (mtv) |

2562 |

2930 |

3632 |

3592 |

|

LARGO |

Brazil |

V2O5 |

9830 |

10577 |

11825 |

10319 |

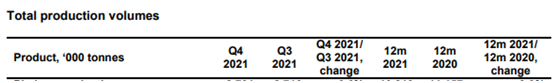

EVRAZ plc

Output of vanadium slag fell by 6.6% QoQ, mostly driven by lower vanadium content in pig iron and reduced pig iron duplex processing volumes. In FY2021, output of vanadium slag rose by 2.7% YoY, mainly because of higher pig iron duplex processing volumes during the year.

Sales of vanadium products surged by 33.0% QoQ, primarily due to higher demand in Europe and North America after a traditionally low market activity in Q3 during the summer months. In FY2021, sales of final vanadium products increased by 5.7% YoY due to overall stronger demand in 2021, caused by the recovery of key steel consuming sectors globally.

The Group’s consolidated crude steel production edged down by 0.4% YoY, as crude steel production volumes fell after Russia introduced an export duty (effective until the end of 2021), which led to lower margins from pig iron production at EVRAZ ZSMK.

|

Product, ‘000 tonnes |

Q4 2021 |

Q3 2021 |

Q4 2021/ Q3 2021, change |

12m 2021 |

12m 2020 |

12m 2021/ 12m 2020, change |

|---|---|---|---|---|---|---|

|

Total crude steel production |

3,384 |

3,403 |

-0.6% |

13,569 |

13,630 |

-0.4% |

|

Russia |

2,904 |

2,912 |

-0.3% |

11,690 |

12,050 |

-3.0% |

|

North America |

480 |

491 |

-2.2% |

1,879 |

1,580 |

18.9% |

|

Iron ore products production |

3,751 |

3,504 |

7.0% |

14,399 |

14,205 |

1.4% |

|

Total sales of steel products1 |

3,188 |

2,979 |

7.0% |

12,469 |

13,062 |

-4.5% |

|

Sales of iron ore products |

479 |

303 |

58.1% |

1,430 |

1,732 |

-17.4% |

|

Sales of vanadium in slag |

2,460 |

1,834 |

34.1% |

7,053 |

6,129 |

15.1% |

|

Sales of vanadium final products2 |

3,809 |

2,864 |

33.0% |

13,288 |

12,567* |

5.7% |

Note. Numbers in this table and the tables below may not add up to totals due to rounding.

1 Includes tonnes of pig iron

2 In tonnes of pure vanadium

* The 2020 data has been adjusted

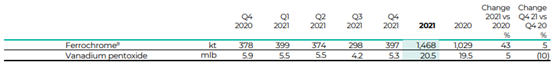

Bushveld Minerals Limited

It achieved Group production for the 12M 2021 of 3,592 mtV, at the upper end of 2021 guidance of between 3,400mtV and 3,600mtV. Production was marginally lower than 12M 2020, which was 3,631 mtV , included Vametco production of 2,654 mtV (includes 15 mtV sold to Vanchem) and Vanchem production of 990 mtV (includes 13 mtV from Vametco). During consolidation of group figures, 13 mtV of AMV produced from Vametco is eliminated.

– H2 2021 Group production of 2,018 mtV was 28.2 per cent higher than H1 2021 (H1 2021: 1,574 mtV), on the back of the operational improvements implemented after the production target rebasing in H1 2021.

Vametco production cash cost (C1) for the 12M 2021 of US$24.0/kgV, in line with guidance of between US$23.7/kgV and US$24.2/kgV.

Vanchem production cash cost (C1) for the 12M 2021 of US$30.6/kgV, in line with guidance of between US$30.3/kgV and US$31.1/kgV.

12M 2021 Group Sales of 3,314 mtV (compared to production of 3,592 mtV), impacted by challenges in international logistics channels arising from COVID-19, the unrest in South Africa and disruptions at local ports in July and August. Consequently, the Company was unable to ship some of the product produced during 2021, resulting in a build of finished products inventory of 278 mtV.

|

Group |

Unit |

Q4 2021 | 12M 2021 |

Q4 2020 |

Q4 2021 vs Q4 2020 |

12M 2021 vs 12M 2020 |

Q4 2021 vs Q3 2021 |

|

Production |

mtV1 |

962 |

3,592 |

951 |

1.1% |

-1.1% |

-8.9% |

|

Sales |

mtV1 |

880 |

3,314 |

1,254 |

-29.8% |

-13.7%2 |

6.5% |

1. mtV = metric tonnes of vanadium.

2. 12M 2021 Group Sales of 3,314 mtV were 13.7 per cent lower than 12M 2020 (12M 2020 3,842 mtV), impacted by not being able to ship some of the product we produced during the second half of 2021, resulting in a build-up of inventory.

|

Company |

Location |

Products |

Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

|

Bushveld |

South Africa(Vanchem) |

V2O5, FeV |

219 |

212 |

294 |

261 |

293 |

293 |

291 |

262 |

|

South Africa(Vametco) |

Vanadium (Nitrovan plus FeV) (mtv) |

652 |

566 |

725 |

703 |

395 |

593 |

765 |

700 |

|

|

Total |

871 |

778 |

1019 |

964 |

688 |

886 |

1056 |

962 |

||

2022 Guidance and Capital Expenditure

Group production of between 4,200 mtV and 4,400 mtV in 2022, with volumes weighted towards the second half due to ramp up, on commissioning Kiln 3 at Vanchem. On track to commission Kiln 3 in Q2 2022, which is expected to increase Vanchem’s annual production from 1,100 mtV to an annual run rate of 2,600 mtV by the end of 2022.

Vametco’s production guidance of between 2,450 mtV and 2,550 mtV, and production cash cost (C1) of between US$22.7/kgV and US$23.5/kgV (ZAR346.9/kgV and ZAR358.7/kgV).

Vanchem’s production guidance of between 1,750 mtV and 1,850 mtV, and production cash cost (C1) of between US$27.7/kgV and US$28.4/kgV (ZAR422.8/kgV and ZAR433.5/kgV).

Largo Inc

Production from the MaracásMenchen Mine was 2,003 tonnes of V2O5 in Q4 2021, representing a decrease of 40% over Q4 2020, which was historically the Company’s strongest production quarter. Lower quarterly production was due to heavy rainfall at the Company’s Maracás operation in November and December. Annual V2O5 production was 10,319 tonnes in 2021, being 13% lower than 2020. Lower annual production was due to the commissioning and ramp up activities associated with the Company’s kiln and cooler upgrades in Q1 2021 and heavy rainfall in November and December. In Q4 2021, global recoveries3 averaged 76.0% as compared to the 80.6% averaged in Q4 2020. The Company achieved an annual average global V2O5 recovery3 rate of 79.7% in 2021, representing a 2.0% decrease over the 81.4% averaged in 2020. The Company mined 1,248,967 tonnes of ore with an effective V2O5 grade2 of 1.00% in 2021 compared to 1,087,518 tonnes with an effective V2O5 grade2 of 1.29% in 2019. The decrease in global recoveries3 and mined ore in 2021 is primarily due to the impacts mentioned above.

Besides, In Q4 2021, the Company completed the ramp up of its V2O3 plant and provided samples to prospective clients for product specification analysis. The Company expects to begin shipping V2O5 to customers in Q1 2022.

2022 Production, Sales and Cost Guidance

The Company has provided solid production, sales and cost guidance for 2022 and management expects to maintain its global competitive position in the vanadium sector.

| V2O5 Equivalent Production and Sales (tonnes) | 12,000 – 12,750 |

| Cash Operating Cost Guidance Excluding Royalties ($/lb sold)4 | $3.20 – 3.40 |

| Vanadium Distribution Costs | $7.0 – 8.0 million |

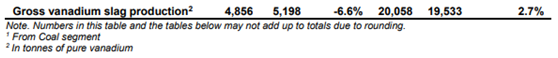

Glencore

In Q4, Glencore produced 5.9 million lb, about 2404.04 tons vanadium pentoxide, 10% higher than that in Q4 2020. In 2021, the overall production for vanadium pentoxide was 20.5 million lb about 9298.75 tons, ascending by 5% y-o-y.

\

\

www.ferroalloynet.com