Vanadium Miners News For The Month Of August 2019

Summary

Vanadium spot prices were only slightly higher in August.

Vanadium market news – Top vanadium producer sees demand rising after prices slump.

Vanadium company news – Australian Vanadium signs MOU for vanadium redox flow battery project collaboration in Australia. Technology Metals Australia delivers a solid DFS, but with higher capex.

I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Welcome to Vanadium miners news. August saw vanadium prices slightly higher. Despite the lower prices the vanadium producers are mostly still doing ok, just not nearly as well as in 2018 at boom vanadium prices. The vanadium juniors look to be making very good progress with some excellent news this month.

Vanadium uses

Vanadium is traditionally used to harden steel. New Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries (VRFBs) are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide (V2O5) is used in VRFBs and Ferrovanadium (FeV) is used in the steel industry.

Vanadium spot price history

China Vanadium Pentoxide (V2O5) Flake 98{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} Price = USD 8.70/lb.

China Ferrovanadium (FeV) 80{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} Price = USD 38.50/kg

Vanadium demand versus supply

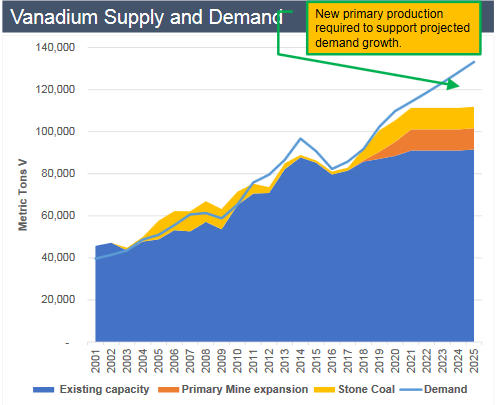

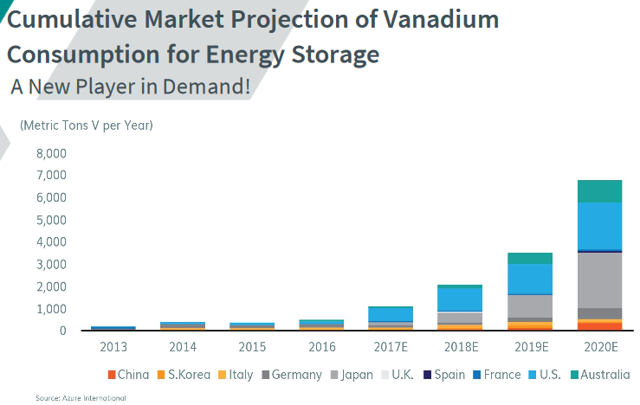

The charts below show energy storage to be a new source of vanadium demand, and overall demand looks likely to grow very strongly to 2025.

Vanadium total demand forecast to outstrip supply 2020-2025

Source: Technology Metals Australia investor presentation and TTP Squared

Roskill estimates that vanadium demand “for VRFB markets” could rise to 31,000 tons by 2025, amounting to a rise of 3,100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} in a decade.

Source: Australian Vanadium presentation

Vanadium market news

In 2017 Robert Friedland stated:

We think there’s a revolution coming in vanadium redox flow batteries,” he says. “You’ll have to get into the mining business and produce ultra-pure vanadium electrolyte for those batteries on a massive scale. We’re very deeply interested in how you store electrical energy in the grid. The beauty of the vanadium redox battery is that you can charge and discharge it at the same time, something that can’t be done with a lithium battery. With a vanadium redox flow battery, you can put solar power and wind power into the battery, and you can put excess grid power into the battery at night, and at the same time you can have a stable output into the grid.

On August 26 Bloomberg reported:

Top vanadium producer sees demand rising after prices slump. Evraz said steelmakers returning to vanadium as price fell. Battery consumption is also recovering, Russian company says…..The Chinese rules relating to construction steel boosted global vanadium demand by as much as 8,000 tons to 95,000 tons in 2018, according to Erenburg. Chinese imports of niobium fell 30{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} in June and July as the steel industry returns to vanadium, he said. Consumption may grow further, if Russia and Europe adopt similar regulations, he said. The industrial batteries market may also bolster growth. So far it is responsible for only 3{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} to 5{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} of demand for vanadium, but the market is now recovering as prices decline, Erenburg said.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTC:OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

On August 7 Glencore announced:

2019 half-year report. Glencore’s Chief Executive Officer, Ivan Glasenberg, commented: “Our performance in the first half reflected a challenging economic backdrop for our commodity mix, as well as operating and cost setbacks within our ramp-up/development assets. Adjusted EBITDA declined 32{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} to $5.6 billion. “The rest of our business, however, remained strong and performed well. Excluding our African copper assets and Koniambo, our metals and coal industrial assets delivered robust Adjusted EBITDA mining margins of 39{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d}. In particular, our copper business, excluding African copper, recorded an EBITDA mining margin of 52{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} and a full unit cash cost of 72c/lb, while our coal business again generated margins in excess of $30/t, basis a $46/t thermal unit cash cost. Similarly, our marketing business is tracking towards the middle of our full year Adjusted EBIT guidance range of $2.2-$3.2 billion, after adjusting for some $350 million of non-cash cobalt losses reported in the first half.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

On July 31 AMG Advanced Metallurgical Group announced: “AMG Advanced Metallurgical Group N.V. reports second quarter 2019 results and updates full year 2019 guidance.” Highlights include:

- “Revenue decreased by 8{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} to $303.6 million in the second quarter 2019 from $329.3 million in the second quarter 2018.

- EBITDA(2) was $23.8 million in the second quarter 2019, a 53{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} decrease over the same period in 2018.

- Annualized return on capital employed was 19.0{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} in the second quarter 2019, as compared to 30.6{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} in the second quarter 2018.

- AMG has returned $81 million to shareholders in 2019 through its share repurchase program and dividend payments.

- AMG declares an interim dividend of €0.20 per ordinary share, unchanged from the interim dividend in the prior year.”

You can view the latest investor presentation here.

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On July 31 Bushveld Minerals Limited announced: “Q2 2019 operational update.” Highlights include:

- “Transformation programme successfully delivering higher production rates with Q2 2019 production recording the highest quarterly production rate in over two years.

- Production for Q2 2019 was 742 mtV in the form of NitrovanTM from magnetite concentrate, a 14 per cent increase relative to Q1 2019 (Q1 2019: 649 mtV), and an 18 per cent improvement relative to Q2 2018 (Q2 2018: 629mtV).

- On target to meet current 2019 production guidance of 2,800 mtV to 2,900 mtV which remains unchanged, underpinned by the continued implementation of several productivity initiatives during the course of H2 2019.

- Unit production cost for H1 2019 was US$17.40/KgV, a 14 percent reduction relative to H1 2018 (H1 2018: US$20.2/KgV), supported by a weaker ZAR relative to the USD during H1 2019, higher volumes and cost reductions.

- Unit production cost guidance of US$18.90/KgV to US$19.50/KgV for the 2019 calendar year remains unchanged due to the anticipation of a stronger ZAR relative to the USD during H2 2019.

- H1 2019 Revenue of US$74.3 million (H1 2018: US$81.2 million) and H1 2019 EBITDA of US$48.6 million (H1 2018: US$42.4 million).

- Vametco achieved an EBITDA margin in excess of 50 per cent, underpinned by strict controls on unit cost and a weaker ZAR.

- At current vanadium prices Vametco remains cash flow positive. During H2 2019 the business will continue to focus on cost control and reduction.”

You can view the latest investor presentation here.

Largo Resources [TSX:LGO] [GR:LR81] (OTCQX:LGORF)

Largo Resources is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil.

On August 13 Largo Resources announced: “Largo Resources announces second quarter 2019 results.” Highlights include:

- “Production of 2,515 tonnes (5.5 million pounds) of V2O5, an increase of 20{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} over Q1 2019 and 2{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} over Q2 2018.

- New monthly V2O5 production record of 1,042 tonnes in July.

- Global V2O5 recovery rate of 79.1{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d}; Second quarter of strong global recoveries in 2019.

- Cash operating costs excluding royalties of $4.43 (US$3.30) per pound of V2O5.

- Revenues of $29.5 million (net of the re-measurement of trade receivables/payables of $46.3 million on vanadium sales from a contract with a customer of $75.8 million).

- Net loss of $20.5 million and a loss per share of $0.04.

- Cash used before non-cash working capital items of $7.8 million.

- Cash balance of $190.3 million exiting Q2 2019.

- Successful start to expansion project ramp up; Ramp up of all areas is expected to be completed by the end of Q3 2019.

- Company remains on track to achieve its production and cost guidance for 2019.”

On August 20 Largo Resources announced:

Largo Resources announces notice to terminate its off-take agreement (with Glencore). Mark Smith, Chief Executive Officer stated: “Our current off-take agreement was instrumental in securing the initial financing for the construction of the Maracás Menchen Mine and allowed the Company to focus solely on producing among the highest purity vanadium in the world. Largo remains one of the lowest-cost vanadium producers in the industry with an established track record of operational performance highlighted by the Company’s new monthly V2O5 production record of 1,042 tonnes in July and global V2O5 recoveries of 80.9{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} exiting Q2 2019.”

You can read more on the above news here.

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio” as well as being a recent vanadium producer.

On August 2 Energy Fuels Inc. announced: “Energy Fuels announces Q2-2019 results.” Highlights include:

- “At June 30, 2019, the Company had $42.6 million of working capital, including $16.6 million in cash, $11.4 million in marketable securities, 485,000 pounds of finished uranium goods inventory, and 610,000 pounds of finished vanadium goods inventory.

- Vanadium production totaled 437,000 pounds of V2O5 for the quarter, and the company expects to continue to produce 160,000 to 200,000 pounds of V2O5 per month through Q3-2019, subject to continued successful recovery and suitable sales prices.

- The Company completed 98,000 pounds of vanadium sales into the steel industry during the quarter at an average price of $7.87 per pound of V2O5, following conversion of the Company’s V2O5 product into ferrovanadium. At the current time, the Company is selling only small quantities of vanadium, while mainly focusing on building V2O5 inventory for sale in the future as the Company expects prices to increase.

- The Company had an operating loss of $11.5 million during the quarter, due primarily to an impairment to inventories of $4.9 million as a result of low uranium prices and a decrease in vanadium prices during the quarter; the decision not to sell any uranium product during the quarter; and the decision to retain most of the Company’s vanadium inventory for future sale…..”

Ferro Alloy Resources [LON:FAR]

No news for the month.

Vanadium developers

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

No news for the month.

Investors can read the latest company presentation here.

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On July 31 Neometals announced: “Quarterly activities report for the quarter ended 30 June 2019.” Highlights include:

Corporate

- Cash $113.7 million, receivables and investments at $8.9million.”

Barrambie Vanadium and Titanium Project

- “DFS update indicates primary vanadium production from the vanadium-rich Central Bands of the Barrambie VTM deposit is technically feasible and economically viable; and

- Pilot scale beneficiation test-work continues to generate concentrates ahead of pilot plant test work on the all-hydrometallurgical flowsheet for the dual recovery of both high-purity titanium and vanadium chemicals. Aim to exploit Central and titanium-rich Eastern Bands with a ‘whole of deposit’ processing solution.”

You can view the latest investor presentation here, or “An Update On Neometals”, or my recent article – “Neometals Managing Director Chris Reed Gives A Brief Update With Matt Bohlsen Of Trend Investing.”

Australian Vanadium [ASX:AVL] [GR:JT71] (OTC:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia.

On August 9 Australian Vanadium announced: “Vanadium pilot scale study update. Testwork demonstrates increased vanadium extraction.” Highlights include:

- “Excellent concentrate quality of 1.44{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 generated from initial pilot scale testing of a weathered composite blended feed, reflecting the planned first 5 years of mine process feed.

- New roast/leach bench scale tests averaging 95{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} vanadium extraction for pelletised concentrate, a significant improvement from PFS estimates.

- 550kg of magnetic concentrate generated from pilot test is currently undergoing roast leach optimisation testwork.

- Pilot scale oxidative roast leach testwork will begin in September.

- Project environmental approval work, resource updates and economic mining studies all advancing steadily.”

On August 20 Australian Vanadium announced:

MOU for vanadium redox flow battery project collaboration in Australia. AVL and VSUN Energy sign MOU with engineering, procurement and construction company Metrowest Power Systems.” Highlights include:

- “AVL, VSUN Energy and Metrowest Power Systems have signed a non-binding MOU to develop opportunities for all parties.

- Metrowest has a strong background in Engineering, Procurement and Construction (EPC) and a deep knowledge in the power industry.

- The MOU will facilitate the installation of energy storage solutions using VRFB technology.”

Catalysts include:

- December 2019 – DFS due

You can view the latest investor presentation here, or read “Australian Vanadium Managing Director Vincent Algar Talks With Matt Bohlsen Of Trend Investing.”

Technology Metals Australia [ASX:TMT]

The company’s primary exploration focus is on the 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia.

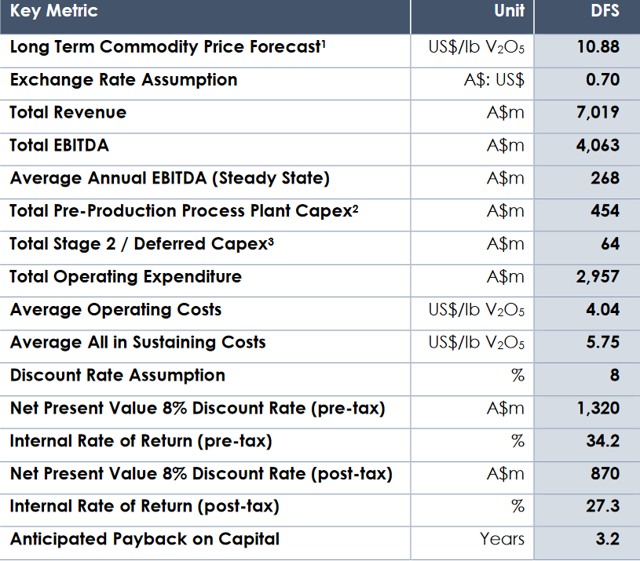

On August 21 Technology Metals Australia announced: “Gabanintha Vanadium Project Definitive Feasibility Study” results: The post-tax NPV8{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} was A$870m, post-tax IRR 27.3{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d}, with C1 cash costs estimated at US$4.04/lb V2O5, at a selling price of US$10.88/lb V2O5. Initial CapEx was A$454m.

A solid result, noting the CapEx increased considerably from the PFS (CapEx A$380m).

Catalysts include:

- 2019 – Any off-take announcements.

- 2020 – Funding or equity partner announcements.

You can view the latest investor presentation here, or read “Technology Metals Australia Execetive Director Ian Prentice Talks With Matt Bohlsen Of Trend Investing.”

TNG Ltd [ASX:TNG] [GR:HJI] (TNGZF)

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd is well advanced with a massive $4.7b NPV8{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d}, but relies on titanium and iron with a lower grade vanadium by-product.

On August 19 TNG Ltd. announced: “Update on front-end engineering and design for the Mount Peake Project.” Highlights include:

Mine schedule focused on two higher grade vanadium pits.

- “A revised mine schedule has been completed by Snowden Mining Industry Consultants (“Snowden”) as part of FEED optimisation activities.

- The revised mine schedule has established that a focus on two higher grade vanadium pits within the Resource during the first 10 years of mining operations could result in a reduced ore mining and processing rate, and fewer tailings produced, while delivering the same targeted magnetite concentrate quality and volumes.”

You can view the latest investor video presentations here.

Aura Energy [ASX:AEE] [GR:VU1] (OTC:AUEEF)

Aura Energy is an Australian-based minerals company that 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} owns polymetallic and uranium projects with large resources in Sweden (Häggån Project) and Mauritania (Tiris project). Aura’s focus is on the Häggån Project, located in Sweden’s Alum Shale Province, one of the largest depositories of vanadium in the world.

On August 14 Aura Energy announced:

Häggån vanadium drilling results confirm high grade zone. Drilling intercepted grades in excess of 0.6{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5. Scoping study continues to progress well. Battery initiative and separate listing options remain active. The most significant results1were as follows; 103metres at 0.41{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 in hole 19DDHG085. 101 metres at 0.43 {3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 in hole 19DDHG089, including 68 metres at 0.5{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5.

You can view the latest investor presentation here.

Prophecy Development Corp. [TSX:PCY] (OTCQX:PRPCF) (NYSEARCA:PCY)

Prophecy Development Corp. is a Canadian public company listed on the Toronto Stock Exchange. Prophecy’s objective is to advance the Gibellini Black Shale primary vanadium project in the Battle Mountain region in northeastern Nevada to production. Gibellini aims to be the first active primary vanadium mine in North America.

On August 19 Prophecy Development Corp. announced:

Prophecy incorporates Silver Elephant Mining Corp and Asia Mining Inc, prepares for silver spinoffs. Prophecy Development Corp. is pleased to announce the formation of two wholly owned Canadian BC subsidiaries; Silver Elephant Mining Corp. (“Silver Elephant”) and Asia Mining Inc. (“Asia Mining”) in order to facilitate potential future spinoffs of the Company’s wholly owned Bolivian silver operation and Mongolian coal operation. John Lee, Prophecy Chairman, states that “we foresee a strong upward performance in silver prices. Silver Elephant is structured and intended to be a premier pure silver play, which may go public in the near term.” The Gibellini vanadium project is firmly on track to formally start the 12-month streamlined Environmental Impact Assessment by early 2020. Prophecy aims to be the single purpose vehicle that offers vanadium investment exposure in Nevada. Gibellini vanadium, Pulacayo silver, and Ulaan Ovoo coal projects had received over US$100million in investment since 2005. Through this reorganization, to be completed by end of August, Prophecy will be the parent company to the following direct subsidiaries.

Note: The stock jumped ~47{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} on the above news. You can view the latest investor presentation here.

Vanadium Resources Limited [ASX:VR8] (formerly Tando Resources [ASX:TNO])

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} of a globally significant vanadium project, the SPD Project, in Gauteng Province, South Africa.

On July 29 Vanadium Resources Limited announced: “Vanadium Resources completes accelerated acquisition.” Highlights include:

- “The accelerated acquisition of the Company’s interest in the Steelportdrift Vanadium Project has now been completed.

- Change of company name to Vanadium Resources Limited is now complete. A new ASX code, VR8, will be operational incoming days.

- Mr Nico van der Hoven and Mr Jurie Wessels welcomed to the board.

- Comprehensive strategy underway to fast-track further development of the VanRes Steelpoortdrift project and assess optimal processing options.

- Major marketing initiative planned in conjunction with Mastermines.”

On August 4 Vanadium Resources Limited announced: “Reserve drilling to commence at Steelpoortdrift Vanadium Project.”

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However their deposits also contain vanadium.

On July 30 King River Resources announced: “Mt Remarkable gold project exploration licences granted.”

On August 20 King River Resources announced:

Speewah specialty metals project update. At a meeting held in Perth 20/8/2019 the Board of King River Resources has adopted a recommendation of Como Engineering to reshape the scale and timing of the Speewah Specialty Metals (SSM) Pre-Feasibility Study (PFS). Test work and recent optimisation studies have identified opportunities to materially reduce the start up capital requirement to build the project without significantly impacting on operational margins scoped in an earlier SSM project summary (please refer to ASX release dated 21/3/2019). The estimated capital costs of constructing a new beneficiation, agitation leaching and metal recovery plant (including direct and indirect costs) would be reduced to ~$524 million (+/-30{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} accuracy) by reducing our start up mining rates to operationally correspond with a more standard sized acid plant installation that is capable of producing over 15 megawatts of electricity per year and 1800 tonnes per day of sulphuric acid.

You can view the latest investor presentation here.

VanadiumCorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:APAFF)

VanadiumCorp Resources Inc. 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has another smaller project known as the Iron-T Vanadium Project also in Quebec, and royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

On August 8 VanadiumCorp Resources Inc. announced:

VanadiumCorp receives mining tax credits. VanadiumCorp Resource Inc. is pleased to announce it has received $556,117.00 CDN from the Province of Quebec on a positive decision regarding files dating back to 2002. The Company will use the funds to further develop its mining assets and the VanadiumCorp Electrochem Process Technology (VEPT).

You can view the latest investor presentation here.

First Vanadium Corp. [TSXV:FVAN] (FVANF) (formerly Cornerstone Metals Inc.)

Cornerstone’s Carlin Vanadium project hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a historic Inferred Resource 28Mt at 0.525{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 (2010 SRK).

On August 7 First Vanadium Corp. announced:

First Vanadium announces preliminary process flow sheet for Carlin Vanadium Project in Nevada. “The Company is very pleased at achieving this major metallurgical milestone for the project…..With the preliminary flow sheet defined, the Company will now initiate Requests for Proposals (RFP’s) from qualified engineering firms for a Preliminary Economic Assessment,” says Paul Cowley, President & CEO.

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTC:OTCPK:SYAAF) (OTC:SRHYY)

- Triton Minerals [ASX:TON] [GR:1TG]

- Battery Minerals [ASX:BAT]

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTCPK:DMNKF)

Other vanadium juniors

- Cellcube Energy Storage [TSXV:CUBE] (STNUF)

- Golden Deeps [ASX:GED]

- Sabre Resources [ASX:SBR]

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Venus Metals [ASX:VMC]

- Intermin Resources [ASX:IRC]

- Vanadium One Energy Corp. [TSXV:VONE] [GR:9VR1] (OTC:VDMRF)

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Maxtech Ventures [CSE:MVT]

- Pursuit Minerals [ASX:PUR]

- Victory Metals [TSXV:VMX]

- BlackRock Metals (Private)

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Cellcube Energy Storage [TSXV:CUBE] (STNUF)

Conclusion

Vanadium spot prices were slightly higher in August.

Highlights for the month include:

- Top vanadium producer sees demand rising after prices slump.

- Glencore reports tough operating conditions.

- AMG announced EBITDA of $23.8 million in the second quarter 2019, a 53{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} decrease over the same period in 2018.

- Bushveld Minerals and Largo Resources both achieve record production rates.

- Energy Fuels vanadium production totaled 437,000 pounds of V2O5 for Q2, 2019. The Company is building inventory of V2O5 in hope of higher future prices.

- Australian Vanadium signs MOU for vanadium redox flow battery project collaboration in Australia.

- Technology Metals Australia Gabanintha Vanadium Project DFS results: Post-tax NPV8{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} was A$870m, post-tax IRR 27.3{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d}, with C1 cash costs estimated at US$4.04/lb V2O5, at a selling price of US$10.88/lb V2O5. Initial CapEx was A$454m.

- Prophecy incorporates Silver Elephant Mining Corp and Asia Mining Inc, prepares for silver spinoffs.

- Vanadium Resources name change completed (formerly Tando Resources), and acquisition of the Company’s interest in the Steelportdrift Vanadium Project has now been completed.

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I’ve done, especially in the electric vehicle and EV metals sector. You can learn more by reading “The Trend Investing Difference“, “Subscriber Feedback On Trend Investing”, or sign up here.

Latest Trend Investing articles:

- Three Great Junior Gold Miners To Consider

- Lynas Corporation Can Be A Winner If The Trade War Worsens

Disclosure: I am/we are long GLENCORE [LSX:GLEN], AMG ADVANCED METALLURGICAL GROUP NV [AMS:AMG], LARGO RESOURCES [TSX:LGO], NEOMETALS [ASX:NMT], AUSTRALIAN VANADIUM [ASX:AVL],TECHNOLOGY METALS AUSTRALIA [ASX:TMT], SYRAH RESOURCES [ASX:SYR], TRITON MINERALS [ASX:TON]. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

www.seekingalpha.com