Vanadium Miners News For The Month Of December 2019

Summary

Vanadium spot prices were slightly lower in December.

Vanadium company news – The U.S. energy storage market is expected to grow by a factor of 12 in the next five years. Gates, Bezos bet on flow battery technology.

Vanadium company news – TNG Ltd. signs binding terms for life-of-mine principal marketing V2O5 agreement with Gunvor, and iron binding off-take deal with Vimson Group.

I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Welcome to Vanadium miners news. December saw vanadium prices slightly lower and quite a busy month for the vanadium junior miners.

Vanadium uses

Vanadium is traditionally used to harden steel. New Chinese rebar standards are requiring more vanadium. Also, Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs, and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

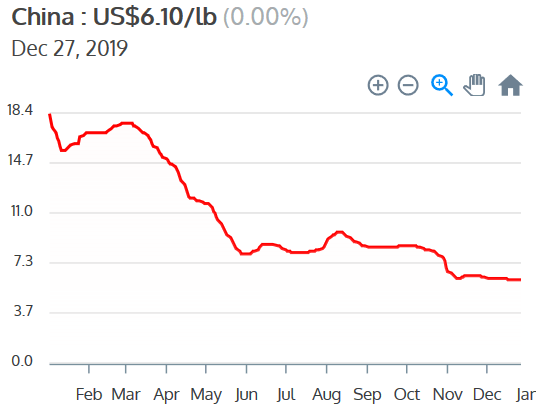

China Vanadium Pentoxide [V2O5] Flake 98% Price = USD 6.10/lb

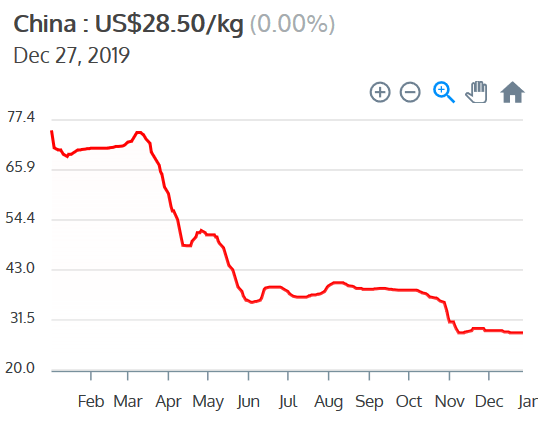

China Ferrovanadium [FeV] 80% Price = USD 28.50

Source: Vanadiumprice.com

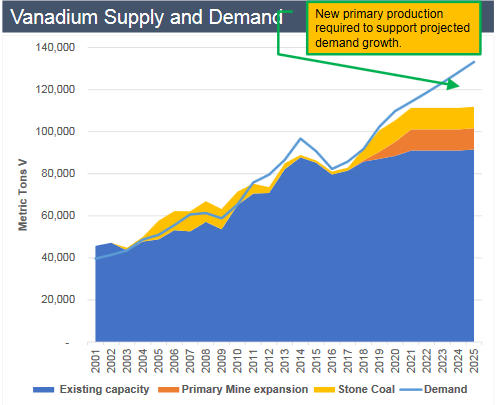

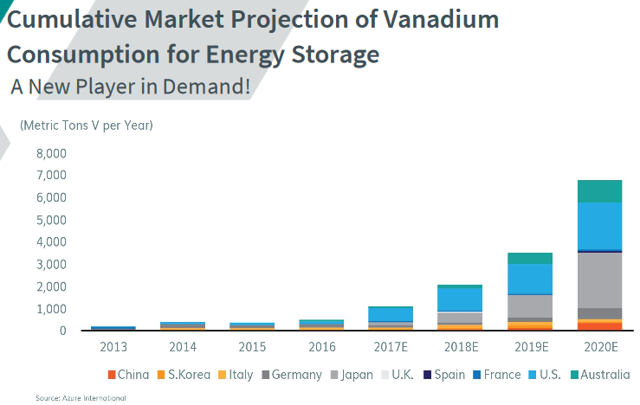

Vanadium demand versus supply

The charts below show energy storage to be a new source of vanadium demand, and overall demand looks likely to grow very strongly to 2025.

Vanadium total demand forecast to outstrip supply 2020-2025

Source: Technology Metals Australia investor presentation & TTP Squared

Roskill estimates that vanadium demand “for VRFB markets” could rise to 31,000 tons by 2025, amounting to a rise of 3,100% in a decade.

Source: Australian Vanadium presentation

Vanadium market news

In 2017, Robert Friedland stated:

We think there’s a revolution coming in vanadium redox flow batteries,” he says. “You’ll have to get into the mining business and produce ultra-pure vanadium electrolyte for those batteries on a massive scale. We’re very deeply interested in how you store electrical energy in the grid. The beauty of the vanadium redox battery is that you can charge and discharge it at the same time, something that can’t be done with a lithium battery. With a vanadium redox flow battery, you can put solar power and wind power into the battery, and you can put excess grid power into the battery at night, and at the same time you can have a stable output into the grid.

On December 19, CNBC reported:

Gates, Bezos bet on flow battery technology, a potential rival to big bets on lithium-ion. Breakthrough Energy Ventures, the group of private investors led by Bill Gates and fellow billionaires Jeff Bezos, Michael Bloomberg, Richard Branson and Jack Ma, invested in iron-flow battery maker ESS in November. The U.S. energy storage market is expected to grow by a factor of 12 in the next five years, from 430MW deployed in 2019 to more than 5GW and a value of more than $5 billion by 2024, says Wood Mackenzie Energy Storage Service. In October of this year, ESS, a manufacturer of low-cost, long-duration, iron-flow batteries for the global renewable energy infrastructure, secured $30 million in a Series C investment round from Breakthrough Energy Ventures, the group of private investors led by Bill Gates and fellow billionaires Jeff Bezos, Michael Bloomberg, Richard Branson, and Jack Ma, among others.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTC:OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

On December 5, Glencore announced:

Investigation by the Serious Fraud Office. Glencore has been notified today that the Serious Fraud Office [SFO] has opened an investigation into suspicions of bribery in the conduct of business of the Glencore group. Glencore will co-operate with the SFO investigation.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

No news for the month.

You can view the latest investor presentation here.

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On December 19, Bushveld Minerals announced:

Update on investment in Enerox GmbH (“Enerox”)…..The investment in Enerox is in line with Bushveld Minerals’ strategy of partnering with Vanadium Redox Flow Battery (“VRFB”) companies and part of the VRFB Investment Platform (“VIP”), as announced on 1 November 2019…..The VIP allows for the flow of investment into VRFB OEMs and provides investors with access to the rapidly growing energy storage market.

You can view the latest investor presentation here.

Largo Resources [TSX:LGO] [GR:LR81] (OTCQX:LGORF)

Largo Resources is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil.

On December 4, Largo Resources announced:

Largo Resources announces extension of its Brazilian tax incentive to 2028. Largo Resources Ltd. is pleased to announce the renewal of its Superintendência do Desenvolvimento do Nordeste (“SUDENE”) tax incentive which extends the Company’s current tax rate of 15.25% to December 2028. The Company’s current SUDENE tax incentive reduces its effective tax rate from 34.0% to 15.25% and was granted in January 2015 for a period of ten years on annual production of 9,636 tonnes of vanadium pentoxide (“V2O5“).

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio”, as well as being a recent vanadium producer.

No news for the month.

Ferro Alloy Resources [LON:FAR]

On December 13, Ferro Alloy Resources announced: “Operational, trading and financing update.” Highlights include:

- “Building expansion at the existing operation completed and first phase of new equipment being commissioned.

- Work on connection to high voltage electricity line commenced and equipment ready for installation.

- Appointment of SRK Consulting (“SRK”) and Coffey International, a Tetra Tech company, for upgrade to Western bankable standards of the Feasibility Study for the development of the large Balasausqandiq Vanadium Project.

- Sharp fall in vanadium pricing has impacted short-term profitability and cash flow, but long-term financial projections still robust at today’s low, and even at significantly lower, vanadium prices.

- Advanced negotiations in progress for near-term funding requirements.

- Positive decision from the Development Bank of Kazakhstan after initial screening for funding of Phase 1 of Balasausqandiq project.”

Vanadium developers

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex, which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

On December 16, Western Uranium & Vanadium Corp. announced:

Western Uranium & Vanadium Corp. operational update…..The Sunday Mine Complex (“SMC”) is located in Colorado within the Uravan Mineral Belt and is comprised of five previously producing uranium/vanadium mines. Successful mine development of the underground workings during 2019 has brought the SMC into production-ready status; mined ore is currently being stockpiled underground. Multiple surface infrastructure projects are underway to meet Colorado Division of Reclamation, Mining and Safety [CDRMS] requirements. Completion of the CDRMS prerequisites will enable the newly mined and stockpiled underground ore to be brought to the surface and samples shipped to prospective customers and processors.

Investors can read the latest company presentation here.

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100% own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

No vanadium related news this month, after last month’s update.

You can view the latest investor presentation here, or “An Update On Neometals”, or my article – “Neometals Managing Director Chris Reed Gives A Brief Update With Matt Bohlsen Of Trend Investing.”

Australian Vanadium [ASX:AVL] [GR:JT71] (OTC:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia.

On November 28, Australian Vanadium announced: “High grade results from resource definition drilling.” Highlights include:

- “New drilling results confirm the consistency and high-grade of the massive magnetite horizons at The Australian Vanadium Project south of Meekatharra, Western Australia.

- 1,224 metres of Reverse Circulation [RC] drilling completed at the Australian Vanadium Project in October 2019.

- Assay results from the thirteen holes have been received.

- Best intersections include: 20m at 1.04% V2O5 from 125m in Hole 19RRC012, including 4m at 1.29% V2O5 from 136m. 17m at 1.23% V2O5 from 38m in Hole 19RRC002, including 8m at 1.30% V2O5 from 62m. 12m at 1.21% V2O5 from 22m in Hole 19RRC003, including 8m at 1.28% V2O5 from 24m. 17m at 1.14% V2O5 from 58m in Hole 19RRC004, including 5m at 1.29% V2O5 from 62m.

- Mineral Resource update underway to incorporate latest RC drill results and diamond drill results from 2019.

- Further drill programmes in advanced planning stage. Targeting southern blocks to convert current Inferred Resources to Indicated Resources.”

On December 20, Australian Vanadium announced: “AVL completes second successful drilling programme.” Highlights include:

- “Resource infill drilling programme completed targeting Mineral Resource upgrades.

- 30 Reverse Circulation [RC] drillholes for 2,336 metres, successfully targeting the high-grade vanadium magnetite horizon.

- Drilling targeted current Inferred Resources south of existing PFS Mineral Reserves for conversion to Indicated Resources category.

- A Mineral Resource update is nearing completion, incorporating drill results from earlier 2018 and 2019 drill programmes.

- Advancing strategy of increasing mine life through adding more Indicated Resources.”

Catalysts include:

- Q4 2019 or early 2020 – Resource upgrade due.

- 2020 – DFS due.

You can view the latest investor presentation here, or read “Australian Vanadium Managing Director Vincent Algar Talks With Matt Bohlsen Of Trend Investing.”

Technology Metals Australia [ASX:TMT]

The company’s primary exploration focus is on the 100% owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia.

On November 29, Technology Metals Australia announced: “CNMNC offtake MOU- Short extension of term.”

On December 17, Technology Metals Australia announced:

Gabanintha vanadium project development status update…..Following the delivery of the very high quality DFS on the development of the globally significant GVP in August 2019 the Company has been in ongoing discussions with offtake partners, equipment vendors and suppliers, strategic partners and project funding parties as well progressing Project environmental and permitting activities. These activities have delivered offtake MOU’s with two counter parties covering 40% of the proposed annual average GVP production; 2,000Tpa V2O5 with CNMC [Ningxia] Orient Group Co., Ltd. (“CNMNC”) and 3,000Tpa V2O5 with Shaanxi Fengyuan Vanadium Technology Development Co., Ltd. (“Fengyuan”), and progressed discussions relating to financial support of the Project with the Northern Australia Infrastructure Facility (“NAIF”) to the Due Diligence Stage of the NAIF assessment process.

Catalysts include:

- 2020 – Further off-take announcements. Funding or equity partner announcements.

You can view the latest investor presentation here, or read “Technology Metals Australia Executive Director Ian Prentice Talks With Matt Bohlsen Of Trend Investing.”

TNG Ltd [ASX:TNG] [GR:HJI]

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd is well advanced with a massive $4.7b NPV 8%, but relies on titanium and iron with a lower grade vanadium by-product.

On December 4, TNG Ltd announced:

TNG extends mandate agreement with KFW IPEX-Bank. Extension of the mandate confirms strong commitment of KfW IPEX-Bank with the financing of the Mount Peake Project.

On December 11, TNG Ltd announced: “TNG signs binding terms for life-of-mine principal marketing agreement with Gunvor [Singapore] for vanadium pentoxide.” Highlights include:

- “Binding Term Sheet for a Life-of-Mine [LOM] Principal Marketing Agreement (the “Agreement”) signed with the major global commodity trader Gunvor [Singapore] for the remaining vanadium pentoxide production from TNG’s 100%-owned Mount Peake Vanadium-Titanium-Iron Project in the Northern Territory.

- Under the Agreement, a maximum of 40% of the vanadium pentoxide to be produced from Mount Peake will be purchased, complementing the existing agreement for the balance with Korea’s WOOJIN….”

On December 12, TNG Ltd announced: “TNG signs binding term sheet with the Vimson Group for life of-mine off-take for Mount Peake iron products.”

You can view the latest investor video presentations here.

Aura Energy [ASX:AEE] [GR:VU1] (OTC:AUEEF)

Aura Energy is an Australian-based minerals company that 100% owns polymetallic and uranium projects with large resources in Sweden (Häggån Project) and Mauritania (Tiris project). Aura’s focus is on the Häggån Project, located in Sweden’s Alum Shale Province, one of the largest depositories of vanadium in the world.

On November 28, Aura Energy announced:

Aura completes of additional Häggån vanadium leaching testwork. V2O5 recovery averaged 96.5% in vanadium targeted oxidative acid pressure leaching tests. Leaching results are strongly supportive for Häggån Vanadium Project.

You can view the latest investor presentation here.

Prophecy Development Corp. [TSX:PCY] (OTCQX:PRPCF)

Prophecy Development Corp. is a Canadian public company listed on the Toronto Stock Exchange. Prophecy’s objective is to advance the Gibellini Black Shale primary vanadium project in the Battle Mountain region in northeastern Nevada to production. Gibellini aims to be the first active primary vanadium mine in North America.

On December 4, Prophecy Development Corp. announced: “Prophecy clears all Bolivian tax liabilities.”

You can view the latest investor presentation here.

Vanadium Resources Limited [ASX:VR8] (formerly Tando Resources [ASX:TNO])

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74% of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

No significant news for the month.

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However, their deposits also contain vanadium.

On December 5, King River Copper announced: “Speewah PFS update and HPA produced.” Highlights include:

- “The waste fraction is expected to be largely devoid of the Iron, Titanium and Vanadium that are acid consuming in the leaching process.

- Removing ~50% of the iron early in the refining flow sheet design is expected to facilitate the solvent extraction of vanadium [V] and titanium [TI].

- The changes in the PFS process design to focus on HPA, with V, Ti and Fe co-products, is expected to deliver a positive impact on the economics of the Speewah project.”

You can view the latest investor presentation here.

Catalysts include:

March 2020 – PFS

Vanadiumcorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:APAFF)

Vanadiumcorp Resources Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

No significant news for the month.

You can view the latest investor presentation here.

First Vanadium Corp. [TSXV:FVAN] (FVANF) (formerly Cornerstone Metals Inc.)

Cornerstone’s Carlin Vanadium project hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large-scale high-grade copper and zinc deposit in Arizona. Carlin has a historic Inferred Resource 28Mt at 0.525% V2O5 (2010 SRK).

On December 17, First Vanadium Corp. announced:

First Vanadium provides compelling gravity map for its newly identified gold target on the Carlin Vanadium Project, Nevada.

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTCPK:SYAAF) (OTC:SRHYY)

- Triton Minerals [ASX:TON] [GR:1TG]

- Battery Minerals [ASX:BAT]

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N] (OTCPK:DMNKF)

Other vanadium juniors

- Golden Deeps [ASX:GED]

- Sabre Resources [ASX:SBR]

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Venus Metals [ASX:VMC]

- Intermin Resources [ASX:IRC]

- Vanadium One Energy Corp. [TSXV:VONE] [GR:9VR1] (OTC:VDMRF)

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Maxtech Ventures [CSE:MVT]

- Pursuit Minerals [ASX:PUR]

- Victory Metals [TSXV:VMX]

- BlackRock Metals (Private)

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- CellCube Energy Storage [TSXV:CUBE] (STNUF)

Conclusion

Vanadium spot prices were slightly lower in December.

Highlights for the month include:

- The U.S. energy storage market is expected to grow by a factor of 12 in the next five years.

- Breakthrough Energy Ventures (backed by Gates, Bezos, Michael Bloomberg, Richard Branson, and Jack Ma) bet on flow battery technology.

- Bushveld Minerals updates investors re their strategy of partnering with Vanadium Redox Flow Battery (“VRFB”) companies.

- Largo Resources announces extension of its Brazilian tax incentive to 2028.

- Western Uranium & Vanadium Corp.’s Sunday Mine Complex (“SMC”) is now production-ready to go, working on CDRMS approvals.

- Technology Metals Australia update – Two off-take partners – 2,000Tpa V2O5 with CNMC [Ningxia] Orient Group Co., Ltd. (“CNMNC”) and 3,000Tpa V2O5 with Shaanxi Fengyuan Vanadium Technology Development Co., Ltd.

- TNG Ltd now has 100% V2O5 off-take partners – Korea’s WOOJIN and major global commodity trader Gunvor [Singapore]. TNG signs binding term sheet with the Vimson Group for life-of-mine off-take for Mount Peake iron products.

- Prophecy clears all Bolivian tax liabilities.

As usual, all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I’ve done, especially in the electric vehicle and EV metals sector. You can learn more by reading “The Trend Investing Difference“, “Subscriber Feedback On Trend Investing”, or sign up here.

Latest Trend Investing articles:

- Buy These Top Mobile Payment Providers To Benefit From One Of The Biggest Trends Of The Next Decade

- An Update On Syrah Resources

Disclosure: I am/we are long GLENCORE [LSX:GLEN], AMG ADVANCED METALLURGICAL GROUP NV [AMS:AMG], LARGO RESOURCES [TSX:LGO], NEOMETALS [ASX:NMT], AUSTRALIAN VANADIUM [ASX:AVL],TECHNOLOGY METALS AUSTRALIA [ASX:TMT], SYRAH RESOURCES [ASX:SYR], TRITON MINERALS [ASX:TON]. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

www.seekingalpha.com