Vanadium Miners News For The Month Of November 2019

Summary

Vanadium spot prices were lower in November.

Vanadium company news – The global energy transition is happening faster than the models predicted.

Vanadium company news – AMG commenced the construction of a new catalyst recycling facility doubling capacity to 60kt pa.

I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Welcome to Vanadium miners news. November saw vanadium prices lower and plenty of news from the vanadium producers and juniors. Looking at current very low vanadium spot prices approaching the marginal cost of production, it looks like the bottom is very near.

Vanadium uses

Vanadium is traditionally used to harden steel. New Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

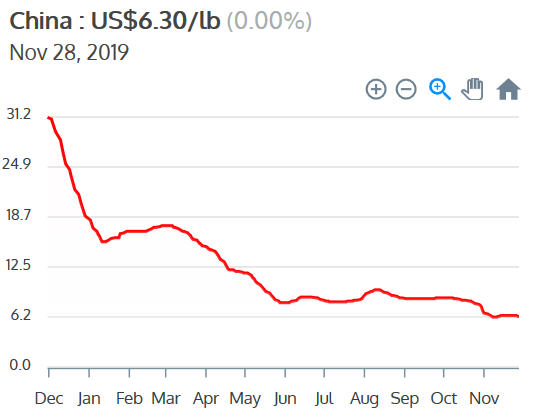

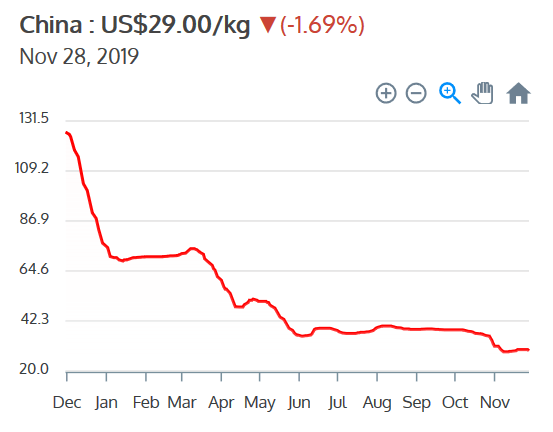

Vanadium spot price history

China Vanadium Pentoxide [V2O5] Flake 98{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} Price = USD 6.30/lb

China Ferrovanadium [FeV] 80{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} Price = USD 29.00

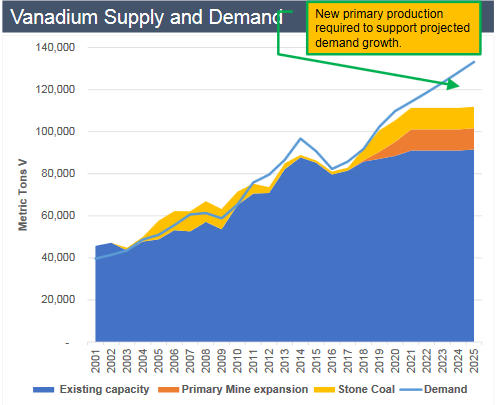

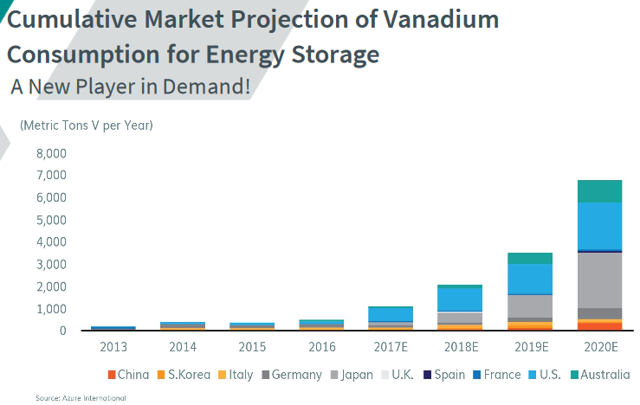

Vanadium demand versus supply

The charts below show energy storage to be a new source of vanadium demand, and overall demand looks likely to grow very strongly to 2025.

Vanadium total demand forecast to outstrip supply 2020-2025

Source: Technology Metals Australia investor presentation & TTP Squared

Roskill estimates that vanadium demand “for VRFB markets” could rise to 31,000 tons by 2025, amounting to a rise of 3,100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} in a decade.

Source: Australian Vanadium presentation

Vanadium market news

In 2017 Robert Friedland stated:

We think there’s a revolution coming in vanadium redox flow batteries,” he says. “You’ll have to get into the mining business and produce ultra-pure vanadium electrolyte for those batteries on a massive scale. We’re very deeply interested in how you store electrical energy in the grid. The beauty of the vanadium redox battery is that you can charge and discharge it at the same time, something that can’t be done with a lithium battery. With a vanadium redox flow battery, you can put solar power and wind power into the battery, and you can put excess grid power into the battery at night, and at the same time you can have a stable output into the grid.

An article I missed from October, PV magazine Australia reported:

Build a better battery for wind and solar storage, and the energy sector will beat a path to your door. A grid-scale 50-megawatt vanadium flow battery is planned for energy storage in the South Australian town of Port Augusta, and China is building the world’s largest vanadium flow battery, expected to come online in 2020.

NX Flow vanadium redox flow batteries connected to a solar array

On October 29 Forbes reported:

Huge battery investments drop energy-storage costs faster than expected, threatening natural gas. The global energy transition is happening faster than the models predicted…. In the first half of 2019 alone, venture-capital firms contributed $1.4 billion to energy storage technology companies. The electric grid will adopt low-cost and long-duration batteries such as zinc-based, flow, and high-temperature batteries. And when EVs become ubiquitous—raising the demand for fast charging—high-power batteries will proliferate.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTC:OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

No vanadium news for the month.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

On October 30, AMG Advanced Metallurgical Group N.V. announced: “AMG Advanced Metallurgical Group N.V. reports third quarter 2019 results.” Highlights include:

Strategic Highlights

- “AMG commenced the construction of a new catalyst recycling facility in Ohio which will double our spent catalyst recycling capacity to 60,000 tons; to finance the expansion, AMG closed on a tax-exempt bond, generating proceeds of $325 million.

- AMG signed a multi-year offtake agreement with Glencore AG to reduce marketing risk and improve working capital management.

- AMG entered into a 50/50 joint venture for the global expansion of catalyst recycling services; upon obtaining the necessary regulatory approvals, the joint venture company, Shell & AMG Recycling B.V., will service the rapidly expanding spent resid catalyst market.

- AMG formed AMG Technologies to integrate its aerospace business units; as part of its growth strategy, AMG Technologies signed a definitive agreement to acquire the assets of International Specialty Alloys (located in New Castle, PA) from Kennametal Inc.”

Financial Highlights

- “AMG completed its share repurchase program which returned $89.9 million to shareholders in 2019.

- Revenue decreased by 18{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} to $269.9 million in the third quarter 2019 from $328.1 million in the third quarter 2018.

- EBITDA(2) was $24.4 million in the third quarter 2019, a 59{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} decrease compared to the same period in 2018……”

On November 21, AMG Advanced Metallurgical Group N.V. announced:

Saudi Arabian General Investment Authority, Shell and AMG sign agreement to assess building a spent residue upgrading catalyst recycling facility…..in Jubail Industrial City, Saudi Arabia.

You can view the latest investor presentation here.

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On October 30 Bushveld Minerals Limited announced:

R375 million debt facilities secured…..Three-year term. Interest rate calculated using the three year or six months JIBAR1 as selected by the Company plus a 3.6{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} margin.

On November 1, Bushveld Minerals Limited announced:

Support for redT-Avalon merger and potential strategic interest in Resulting Entity. (Bushveld) has agreed to support the merger of Avalon Battery Corporation (“Avalon”) and redT energy plc (“‘redT”) (the “Merger”) with interim funding of US$5 million which will give Bushveld the opportunity to acquire a strategic interest in the merged energy storage company.

On November 7, Bushveld Minerals Limited announced: “Bushveld Minerals Q3 2019 Operational Update.” Highlights include:

- “Today, Bushveld Minerals announced the successful completion of the Vanchem acquisition for a total consideration of US$53.5 million, reduced from the initially agreed US$68 million.

- Vametco’s production for Q3 2019 was 561 mtV in the form of NitrovanTM from magnetite concentrate, a 24 per cent decrease relative to Q2 2019 (Q2 2019: 742 mtV) due to a planned maintenance programme, as previously announced……

- Vametco’s production for the nine months ended 30 September 2019 was 1,953 mtV a three per cent increase from the prior corresponding period (9M 2018: 1,897mtV).

- Vametco is on track to meet its production guidance of 2,800 mtV to 2,900 mtV for the 2019 financial year, underpinned by its improved operational performance.

- Unit production cost of US$18.90/KgV to US$19.50/KgV for the 2019 financial remains on track.

- On 21 October 2019, the Company announced that the Department of Mineral Resources and Energy (“DMRE”) approved its mining right application in respect of the Mokopane Vanadium Project. The Company is currently finalising the required documentations in order to execute the mining right.”

On November 12, Bushveld Minerals Limited announced: “Potential investment in Enerox GmbH. (“Enerox”).”

You can view the latest investor presentation here.

Largo Resources [TSX:LGO] [GR:LR81] (OTCQX:LGORF)

Largo Resources is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil.

On November 13, Largo Resources announced: “Largo Resources announces third quarter 2019 results.” Highlights

- “Production of 2,952 tonnes (6.5 million pounds) of V2O5, a 15{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} increase over Q3 2018.

- Cash operating costs excluding royalties of US$2.81 ($3.71) per pound of V2O5, a decrease of 8{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} over Q3 2018.

- Revenues of $32.1 million (net of the re-measurement of trade receivables/payables of $20.4 million on vanadium sales from a contract with a customer of $52.5 million).

- Net loss of $8.6 million and a loss per share of $0.02.

- Cash balance of $154.8 million exiting Q3 2019.

- Average annual cash operating costs excluding royalties2 guidance lowered to US$3.30 to $3.40 per lb V2O5; Annual production guidance maintained.

- Expansion project expected to conclude in November 2019.

- Board approval for the construction of a ferrovanadium plant in Maracás, Brazil.”

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio”, as well as being a recent vanadium producer.

On November 1, Energy Fuels Inc. announced: “Energy Fuels announces Q3-2019 results.” Highlights include:

- “At September 30, 2019, the Company had $41.1 million of working capital, including $14.7 million in cash, $7.8 million in marketable securities, 500,000 pounds of uranium finished goods inventory, and 1,150,000 pounds of vanadium finished goods inventory.

- Vanadium production totaled 530,000 pounds of V2O5 for the quarter, and the Company expects to continue to produce 160,000 to 200,000 pounds of V2O5 per month through Q4-2019, subject to continued successful recovery and suitable sales prices.

- Uranium production totaled 16,000 pounds of U3O8 during the quarter.

- The Company did not complete any uranium sales during the quarter.

- At the current time, the Company is selling only small quantities of vanadium, while mainly focusing on building V2O5 inventory for sale in the future to capitalize on any future price increases in vanadium markets that are often volatile.

- The Company had an operating loss of $8.8 million during the quarter, due in part to an impairment to inventories of $2.3 million as a result of low uranium prices and a decrease in vanadium prices during the quarter; as well as the decision to limit uranium and vanadium sales during the quarter….

- On July 13, 2019, the Company announced that it had entered into a new processing agreement, whereby the owner of a formerly producing uranium mine in New Mexico will deliver cleanup ore material from the mine for processing and recovery of uranium at the Company’s White Mesa Mill. Revenues payable to the Company are expected to be between $700,000 and $3.5 million. In addition, the Company will retain any uranium recovered from the material for its own account, which is expected to total between 8,000 and 70,000 pounds of U3O8, or approximately $200,000 to $1.75 million at today’s spot prices…..”

Ferro Alloy Resources [LON:FAR]

No significant news for the month.

Vanadium developers

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

No news for the month.

Investors can read the latest company presentation here.

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On October 30, Neometals announced: “Quarterly activities report for the quarter ended 30 September 2019.” Highlights include:

Corporate

- “Significant commercial activity culminating in partnership agreements signed during and post the quarter.

- Cash $107.1 million, receivables and investments at $9.4 million.”

Barrambie Titanium and Vanadium Project

- “MOU signed post the period end with China’s IMUMR which defines joint milestones ahead of a potential 50:50 operating JV to develop the project.

- Successful preliminary metallurgical test-work has defined the optimal flowsheet for pilot scale beneficiation test-work to commence in the December quarter.

- Beneficiation pilot plant output will be supplied to IMUMR for demonstration plant test-work in China.”

On November 20, Neometals announced: “Barrambie update–titanium milestone achieved.” Highlights include:

- “Key milestone achieved for the all-hydrometallurgical process flowsheet to recover titanium and vanadium chemicals from Barrambie.

- Commenced preparation in Australia of concentrate feedstocks for proposed demonstration plant.”

You can view the latest investor presentation here, or “An Update On Neometals”, or my article – “Neometals Managing Director Chris Reed Gives A Brief Update With Matt Bohlsen Of Trend Investing.”

Australian Vanadium [ASX:AVL] [GR:JT71] (OTC:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia.

On October 29, Australian Vanadium announced: “Option agreement to locate vanadium processing plant near Geraldton.”

Catalysts include:

- Q4 2019 – Resource upgrade due.

- December 2019 – DFS due.

You can view the latest investor presentation here, or read “Australian Vanadium Managing Director Vincent Algar Talks With Matt Bohlsen Of Trend Investing.”

Technology Metals Australia [ASX:TMT]

The company’s primary exploration focus is on the 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia.

On October 31, Technology Metals Australia announced: “Quarterly activities report & appendix 5b for the quarter ending 30 September 2019.”

Catalysts include:

- 2019 – Further off-take announcements.

- 2020 – Funding or equity partner announcements.

You can view the latest investor presentation here, or read “Technology Metals Australia Execetive Director Ian Prentice Talks With Matt Bohlsen Of Trend Investing.”

TNG Ltd [ASX:TNG] [GR:HJI] (TNGZF)

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd is well advanced with a massive $4.7b NPV8{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d}, but relies on titanium and iron with a lower grade vanadium by-product.

On October 30, TNG Ltd. announced:

Environmental impact statement submitted for TNG’s Darwin TIVAN® processing facility. Submission of the EIS for the Darwin TIVAN® Processing Facility represents a key milestone for the development of the Mount Peake Project and the final major permitting requirement.

On November 13, TNG Ltd. announced:

TNG receives $2.18m research & development rebate……The receipt of the R&D rebate adds to our existing cash balance, which stood at $20.8 million at the end of the September quarter, providing the Company with a solid financial foundation as the various work streams being progressed continue to advance the Mount Peake Project towards development.”

You can view the latest investor video presentations here.

Aura Energy [ASX:AEE] [GR:VU1] (OTC:AUEEF)

Aura Energy is an Australian-based minerals company that 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} owns polymetallic and uranium projects with large resources in Sweden (Häggån Project) and Mauritania (Tiris project). Aura’s focus is on the Häggån Project, located in Sweden’s Alum Shale Province, one of the largest depositories of vanadium in the world.

On October 31, Aura Energy announced: “September quarterly report.”

You can view the latest investor presentation here.

Prophecy Development Corp. [TSX:PCY] (OTCQX:PRPCF) (NYSEARCA:PCY)

Prophecy Development Corp. is a Canadian public company listed on the Toronto Stock Exchange. Prophecy’s objective is to advance the Gibellini Black Shale primary vanadium project in the Battle Mountain region in northeastern Nevada to production. Gibellini aims to be the first active primary vanadium mine in North America.

On November 7, Prophecy Development Corp. announced: “Prophecy submits Nevada state mine operating permit applications for Gibellini Vanadium Project.”

You can view the latest investor presentation here.

Vanadium Resources Limited [ASX:VR8] (formerly Tando Resources [ASX:TNO])

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

On October 30, Vanadium Resources Limited announced: “Quarterly activities report-October 2019.” Highlights include:

- “First Asian marketing tour concluded, including meetings with Chinese, Korean and Japanese participants in the vanadium market…..

- Samples being sent to be tested by both potential customers and independent testing facilities.

- Reserve drilling successfully completed with first results including consistent high in situ grades of +1.0{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 in LMZ…..

- Accelerated acquisition of the Company’s interest in the Steelpoortdrift vanadium project completed….

- Comprehensive strategy underway to fast-track further development of the VanRes Steelpoortdrift project and assess optimal processing options.”

On November 19, Vanadium Resources Limited announced: “High grade drill intersections continue as resource estimation commences.” Highlights include:

- “All results from reserve drilling have now been received.

- Receipt of results enables commencement of Mineral Resource update.

- Consistent surface in situ grades of +1.0{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 including: 8m at 1.24{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5. 9m at 1.20{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5. 10m at 1.18{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5. 11m at 1.17{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5. 9m at 1.17{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5. 10m at 1.12{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5.

- Results continue to demonstrate the high grade, high quality nature of the Steelpoortdrift Vanadium Project.”

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However their deposits also contain vanadium.

On November 6, King River Copper announced:

Central deposit mineral resource amendment….The Central deposit comprises a Measured, Indicated and Inferred Mineral Resource of 1,240 million tonnes at 0.31 V2O5, 3.3{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} TiO2, 14.6{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} Fe, 12.5{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} Al2O3 and 4.7{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} MgO (reported at a 0.23{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 cut-off grade).

On November 26, King River Copper announced:

High purity alumina. King River Resources Limited is pleased to provide this Pre Feasibility Study (“PFS”) update on the company’s 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} owned Speewah Specialty Metals Project in the East Kimberley of Western Australia. Optimisation testwork work and trade-off studies are well under way and the PFS is now expected to be completed in the March 2020 quarter.

You can view the latest investor presentation here.

Upcoming catalysts

March 2020 – PFS

VanadiumCorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:APAFF)

VanadiumCorp Resources Inc. 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has another smaller project known as the Iron-T Vanadium Project also in Quebec, and royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

On October 30, Vanadiumcorp Resource Inc. announced:

VanadiumCorp Resource Inc. (TSX-V: “VRB”) (the “Company”) is pleased to announce that on October 18th, 2019, it entered into a Definitive Agreement whereby a private Canadian corporation (“Private Company”) may earn a 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} interest in the Company’s Iron-T Vanadium-Titanium-Iron Project through a three-stage option (“The Option”). Should the project reach production, a first right of refusal is granted; allowing VanadiumCorp to acquire up to 200,000 metric tonnes per annum “MTPA” of vanadiferous titanomagnetite “VTM” concentrate, as an offtake valid for life of mine.

On November 5, Vanadiumcorp Resource Inc. announced:

VanadiumCorp forms subsidiary and acquires facility for VRFB production in Germany…..VanadiumCorp GmbH introduces XRG® as next generation energy storage technology powered by its own supply chain. Components are both manufactured sustainably and are 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} reusable & recyclable.

You can view the latest investor presentation here.

First Vanadium Corp. [TSXV:FVAN] (FVANF) (formerly Cornerstone Metals Inc.)

Cornerstone’s Carlin Vanadium project hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a historic Inferred Resource 28Mt at 0.525{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 (2010 SRK).

On November 12, First Vanadium Corp. announced: “Gold target identified on the Carlin Vanadium Project by prominent Nevada geologist.”

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTC:OTCPK:SYAAF) (OTC:SRHYY)

- Triton Minerals [ASX:TON] [GR:1TG]

- Battery Minerals [ASX:BAT]

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTCPK:DMNKF)

Other vanadium juniors

- Cellcube Energy Storage [TSXV:CUBE] (STNUF)

- Golden Deeps [ASX:GED]

- Sabre Resources [ASX:SBR]

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Venus Metals [ASX:VMC]

- Intermin Resources [ASX:IRC]

- Vanadium One Energy Corp. [TSXV:VONE] [GR:9VR1] (OTC:VDMRF)

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Maxtech Ventures [CSE:MVT]

- Pursuit Minerals [ASX:PUR]

- Victory Metals [TSXV:VMX]

- BlackRock Metals (Private)

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Cellcube Energy Storage [TSXV:CUBE] (STNUF)

Conclusion

Vanadium spot prices were lower in November.

Highlights for the month include:

- Very low vanadium spot prices approaching the marginal cost of production, it looks like the bottom is very near.

- The global energy transition is happening faster than the models predicted.

- AMG commenced the construction of a new catalyst recycling facility doubling capacity to 60kt pa. AMG signed a multi-year offtake agreement with Glencore.

- Bushveld Minerals announced the successful completion of the Vanchem acquisition for a total consideration of US$53.5 million.

- Largo Resources reports a Q3 2019 net loss of $8.6 million and a loss per share of $0.02. Board approval for the construction of a ferrovanadium plant in Maracás, Brazil.

- Energy Fuels – “the Company is selling only small quantities of vanadium, while mainly focusing on building V2O5 inventory for sale in the future to capitalize on any future price increases in vanadium markets.”

- Neometals – MOU signed post the period end with China’s IMUMR which defines joint milestones ahead of a potential 50:50 operating JV to develop the Barrambie Project.

- Vanadiumcorp Resource Inc options 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} of their VanadiumCorp’s Iron-T Vanadium Project, but retains 200ktpa vanadiferous titanomagnetite “VTM” concentrate off-take option. VanadiumCorp forms subsidiary and acquires facility for VRFB production in Germany.

- First Vanadium Corp. – Gold target identified on the Carlin Vanadium Project by prominent Nevada geologist.

www.seekingalpha.com