Vanadium Miners News For The Month Of September 2019

Summary

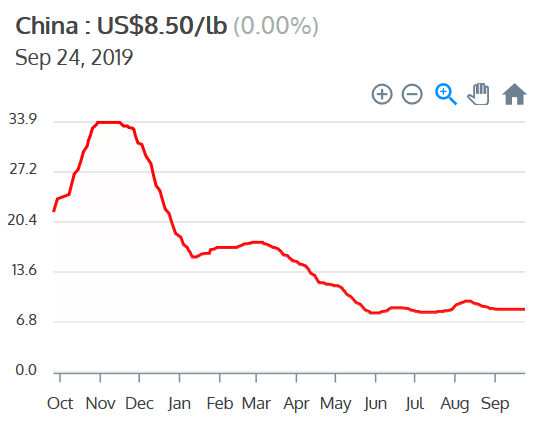

Vanadium spot prices were very slightly lower in September.

Vanadium market news – Fastmarkets – Oversupply will continue to cast shadow on Chinese vanadium market in H2 2019.

Vanadium company news – Bushveld Minerals receives approval to buy the Vanchem assets. Australian Vanadium receives Government major project status.

I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Welcome to Vanadium miners news. September saw vanadium prices very slightly lower and a quieter month for news.

Vanadium uses

Vanadium is traditionally used to harden steel. New Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

China Vanadium Pentoxide [V2O5] Flake 98{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} Price = USD 8.50/lb.

China Ferrovanadium [FeV] 80{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} Price = USD 38.30/kg

Vanadium demand versus supply

On September 11 Fastmarkets reported: “Cheaper vanadium imports to China weigh on already weak domestic market.”

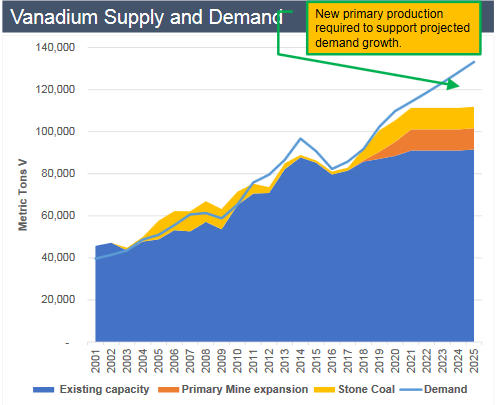

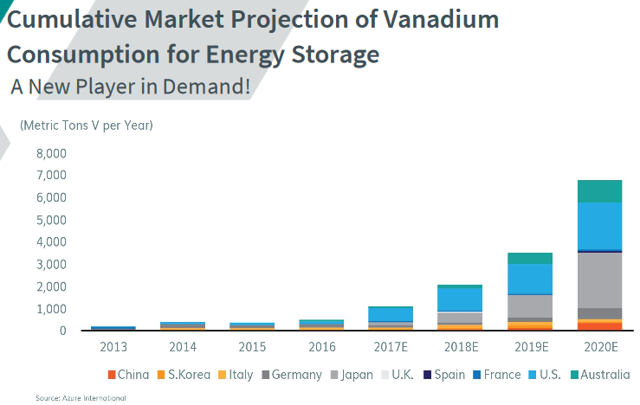

The charts below show energy storage to be a new source of vanadium demand, and overall demand looks likely to grow very strongly to 2025.

Vanadium total demand forecast to outstrip supply 2020-2025

Source: Technology Metals Australia investor presentation & TTP Squared

Roskill estimates that vanadium demand “for VRFB markets” could rise to 31,000 tons by 2025, amounting to a rise of 3,100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} in a decade.

Source: Australian Vanadium presentation

Vanadium market news

In 2017 Robert Friedland stated:

We think there’s a revolution coming in vanadium redox flow batteries,” he says. “You’ll have to get into the mining business and produce ultra-pure vanadium electrolyte for those batteries on a massive scale. We’re very deeply interested in how you store electrical energy in the grid. The beauty of the vanadium redox battery is that you can charge and discharge it at the same time, something that can’t be done with a lithium battery. With a vanadium redox flow battery, you can put solar power and wind power into the battery, and you can put excess grid power into the battery at night, and at the same time you can have a stable output into the grid.

On August 16 Fastmarkets reported:

Oversupply will continue to cast shadow on Chinese vanadium market in H2 2019, sources say. An oversupply that has been branded the leading cause of the persistent price weakness seen in China’s vanadium market during the first half of 2019 will likely continue to act as a headwind for the rest of the year, market sources told Fastmarkets. Vanadium prices in China were on a general downward trajectory in the first six months of 2019, partly due to higher-than-expected supply and weaker-than-anticipated demand, market sources said….. Both supply and demand for vanadium products in China have seen obvious increases in the first half of 2019, but growth of supply has outpaced that of demand, weighing on Chinese vanadium prices as a result, market participants told Fastmarkets….. “The price surge seen last year [in vanadium products] was irrational and has dented mills’ trust in the utilization of the alloy’s products, prompting them to use more alternatives, and in most cases ferro-niobium.”

On September 2 Investing News reported:

Investing in the Vanadium Industry. Roskill’s latest vanadium market report says that 91 percent of vanadium is used as an additive in the steel industry to make high-strength steel that is lighter, stronger and more resistant to shock and corrosion. Vanadium content of less than 0.1 percent is needed to double the strength of steel, and although other metals — including manganese, molybdenum, niobium, titanium and tungsten — can be interchanged with vanadium for alloying with steel, there is no substitute for vanadium in aerospace titanium alloys….. Currently, vanadium redox batteries are generating excitement because they are reusable over semi-infinite cycles, and do not degrade for at least 20 years, allowing energy storage systems the ability to bank renewable energy. However, these batteries are quite large compared to lithium-ion batteries, and are better suited for industrial or commercial use than for use in electric vehicles……Roskill expects the market for stationary energy storage to increase from less than 2 gigawatt hours in 2017 to 16 gigawatt hours by 2026. The firm notes that vanadium redox batteries currently account for just a fraction of the battery technologies and energy storage market, but even slight growth in market share could potentially add tens of kilotonnes of demand to the market.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTC:OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

On September 5 Glencore announced: “Notice to holders of the U.S.$625 million non-dilutive cash-settled guaranteed convertible bonds due 2025 issued by Glencore Funding LLC (the “Bonds”, ISIN: XS1799614232).”

No vanadium related news.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

No news for the month. Last month they completed their massive share repurchase program of EUR 72,234,898 (from April 9, 2019 to August 9, 2019).

You can view the latest investor presentation here.

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On August 29 Bushveld Minerals announced:

Vanchem update-Competition commission approval. Bushveld Minerals Limited, the AIM listed, integrated primary vanadium producer, with ownership of high grade vanadium assets, is pleased to announce that on 28 August 2019, it received approval from the Competition Commission of South Africa to acquire the Vanchem assets, without conditions. Fortune Mojapelo, CEO of Bushveld Minerals Limited, commented: “Competition Commission approval marks yet another key milestone in closing this exciting transaction. We remain on track to complete the acquisition within our targeted timeframe, at which point we will have significantly increased our processing capacity, giving us the ability to unlock even more of our existing large high grade resource base and produce a diverse array of products for the steel market, chemical industry and energy storage sector. Furthermore, significant progress is being made in respect of the preparation ahead of the integration of Vanchem post transaction closure.”

You can view the latest investor presentation here.

Largo Resources [TSX:LGO] [GR:LR81] (OTCQX:LGORF)

Largo Resources is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil.

On September 9 Largo Resources announced: “Largo announces promotion of Paulo Misk to CEO and J. Alberto Arias to Chairman.”

You can read more on the above news here.

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio”, as well as being a recent vanadium producer.

No news for the month.

Ferro Alloy Resources [LON:FAR]

On August 29 Ferro Alloy Resources announced:

Financial statements for H1 2019. 55{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} year-on-year increase in production at the Existing Operation; production of vanadium pentoxide in H1 2019 totalled 72.5 tonnes.

Vanadium developers

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

On September 11 Western Uranium & Vanadium Corp. announced:

Western Uranium & Vanadium Corp. update. Western Uranium & Vanadium Corp. The Sunday Mine Complex Vanadium Project continues to deliver favorable results. The initial sampling from the face of the mine workings showed V2O5 grades ranging from 3{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} to 14{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d}. Large quantities of ore were mined to determine expected production grades. Twelve samples were analyzed from the four mines from 12 areas mined. The average grade of vanadium was 3.15{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d}.

Investors can read the latest company presentation here.

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On September 13 Neometals announced: “Annual financial report for the financial year ended 30 June 2019.”

You can view the latest investor presentation here, or “An Update On Neometals”, or my article – “Neometals Managing Director Chris Reed Gives A Brief Update With Matt Bohlsen Of Trend Investing.”

Australian Vanadium [ASX:AVL] [GR:JT71] (OTC:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia.

On August 30 Australian Vanadium announced:

World-leading Kiln supplier to conduct vanadium pilot roast work for AVL. AVL’s vanadium roast pilot to be undertaken at Metso’s Danville, Pennsylvania facilities in the USA.

On September 4 Australian Vanadium announced:

AVL secures vanadium Redox Flow Battery sale. Vanadium Redox Flow Battery to form part of solar and energy storage system at an orchard in Victoria.

On September 6 Australian Vanadium announced: “Major project status awarded to the Australian Vanadium Project. Australian Vanadium Limited has received Federal Government recognition of its high-grade vanadium Project’s importance to Australia.”

On September 13 Australian Vanadium announced: “MOU signed for remote renewable energy system.”

Catalysts include:

- Q4 2019 – Resource upgrade due.

- December 2019 – DFS due.

You can view the latest investor presentation here, or read “Australian Vanadium Managing Director Vincent Algar Talks With Matt Bohlsen Of Trend Investing.”

Technology Metals Australia [ASX:TMT]

The company’s primary exploration focus is on the 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia.

No news for the month.

Catalysts include:

- 2019 – Any off-take announcements.

- 2020 – Funding or equity partner announcements.

You can view the latest investor presentation here, or read “Technology Metals Australia Execetive Director Ian Prentice Talks With Matt Bohlsen Of Trend Investing.”

TNG Ltd [ASX:TNG] [GR:HJI] (TNGZF)

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd is well advanced with a massive $4.7b NPV8{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d}, but relies on titanium and iron with a lower grade vanadium by-product.

On September 11 TNG Ltd. announced: “Optimised Mount Peake Project delivery strategy: A single-stage 2Mtpa development.” Highlights include:

- “Optimised single-stage, 2Mtpa development of the Mount Peake Projects elected by TNG’s project delivery team.

- Mining schedule will initially focus on two high-grade vanadium zones.

- Review indicates potential reduction in overall pre-production CAPEX of A$29million; with the Company electing to absorb this amount in increased contingency to further de-risk the Project: CAPEX is now estimated at A$824million.

- Under the single stage 2Mtpa plan the life of mine extends to 37 years…

- Other key financial outcomes include: -Life-of-mine net cash-flow A$12.2 billion-Pre-tax NPV8{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} of A$2.8billion and pre-tax IRR of 33{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d}-Capital payback of 2.8years….

- Mine Management Plan [MMP] and Environmental Impact Statement [EIS] nearing completion and submission.”

On September 13 TNG Ltd. announced: “Update on Mount Peake iron ore off-take.” (no details here as not related to vanadium)

You can view the latest investor video presentations here.

Aura Energy [ASX:AEE] [GR:VU1] (OTC:AUEEF)

Aura Energy is an Australian-based minerals company that 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} owns polymetallic and uranium projects with large resources in Sweden (Häggån Project) and Mauritania (Tiris project). Aura’s focus is on the Häggån Project, located in Sweden’s Alum Shale Province, one of the largest depositories of vanadium in the world.

No significant news for the month.

You can view the latest investor presentation here.

Prophecy Development Corp. [TSX:PCY] (OTCQX:PRPCF) (NYSEARCA:PCY)

Prophecy Development Corp. is a Canadian public company listed on the Toronto Stock Exchange. Prophecy’s objective is to advance the Gibellini Black Shale primary vanadium project in the Battle Mountain region in northeastern Nevada to production. Gibellini aims to be the first active primary vanadium mine in North America.

On September 9 Prophecy Development Corp. announced: “Prophecy Development closes $2,600,000 private placement with insiders and strategic investor.”

You can view the latest investor presentation here.

Vanadium Resources Limited [ASX:VR8] (formerly Tando Resources [ASX:TNO])

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

On September 17 Vanadium Resources Limited announced: “Successful Asian marketing tour.” Highlights include

- “First Asian marketing tour concluded, including meetings with Chinese, Korean and Japanese participants in the vanadium market.

- Strong interest due to the world class nature of the Steelpoortdrift Vanadium Project–specifically its high grade and substantial tonnage.

- Staged development model focused on rapid development of downstream processing solutions being developed by the Company.

- Samples being sent to be tested by both potential customers and independent testing facilities.

- Ongoing discussions with interested parties with follow up visit planned in around 6weeks’ time.”

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However their deposits also contain vanadium.

On September 6 King River Copper announced: “Annual report for the year ended 30 June 2019.”

You can view the latest investor presentation here.

VanadiumCorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:APAFF)

VanadiumCorp Resources Inc. 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has another smaller project known as the Iron-T Vanadium Project also in Quebec, and royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

On September 3 VanadiumCorp Resources Inc. announced:

VanadiumCorp launches 8,500m infill and extension drilling program at its Lac Dore Vanadium Project in Quebec.

On September 20 VanadiumCorp Resources Inc. announced: “Update on drilling at Lac Doré.” Highlights include:

- “16 holes completed to date for a total of 4,346 m of drilling….

- Banded semi-massive to massive titanomagnetite mineralization observed in all drill holes.

- Potential for elevated V2O5 grades in the P1 stratigraphic unit and in the lower parts of the P2 unit, both of which contain moderate magnetite grades relative to the upper part of the P2 unit which hosts the main bands of massive to semi-massive vanadium bearing magnetite.”

You can view the latest investor presentation here.

First Vanadium Corp. [TSXV:FVAN] (FVANF) (formerly Cornerstone Metals Inc.)

Cornerstone’s Carlin Vanadium project hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a historic Inferred Resource 28Mt at 0.525{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 (2010 SRK).

No news for the month.

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTC:OTCPK:SYAAF) (OTC:SRHYY)

- Triton Minerals [ASX:TON] [GR:1TG]

- Battery Minerals [ASX:BAT]

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTCPK:DMNKF)

Other vanadium juniors

- Cellcube Energy Storage [TSXV:CUBE] (STNUF)

- Golden Deeps [ASX:GED]

- Sabre Resources [ASX:SBR]

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Venus Metals [ASX:VMC]

- Intermin Resources [ASX:IRC]

- Vanadium One Energy Corp. [TSXV:VONE] [GR:9VR1] (OTC:VDMRF)

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Maxtech Ventures [CSE:MVT]

- Pursuit Minerals [ASX:PUR]

- Victory Metals [TSXV:VMX]

- BlackRock Metals (Private)

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Cellcube Energy Storage [TSXV:CUBE] (STNUF)

Conclusion

Vanadium spot prices were very slightly lower in September.

Highlights for the month include:

- Vanadium content of less than 0.1 percent is needed to double the strength of steel.

- Fastmarkets – Oversupply will continue to cast shadow on Chinese vanadium market in H2 2019.

- Roskill expects the market for stationary energy storage to increase from less than 2 gigawatt hours in 2017 to 16 gigawatt hours by 2026.

- Bushveld Minerals receives approval to buy the Vanchem assets.

- Western Uranium & Vanadium Sunday Mine Complex Vanadium Project – The initial sampling from the face of the mine workings showed very good V2O5 grades. The average grade of vanadium was 3.15{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d}.

- Australian Vanadium secures vanadium Redox Flow Battery sale. Federal Government awards major project status awarded to the Australian Vanadium Project.

- TNG Ltd. delivers an optimised Mount Peake Project delivery strategy: A single-stage 2Mtpa development with lower CapEx.

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I’ve done, especially in the electric vehicle and EV metals sector. You can learn more by reading “The Trend Investing Difference“, “Subscriber Feedback On Trend Investing”, or sign up here.

Latest Trend Investing articles:

- The Era Of The Truly Affordable Electric Car Is Finally Arriving Soon Helped By Renault

- YPB Group Has Potential To Boom With Their Anti-Counterfeit Technology

Disclosure: I am/we are long Glencore [LSX:GLEN], AMG Advanced Metallurgical Group NV [AMS:AMG], LARGO RESOURCES [TSX:LGO], NEOMETALS [ASX:NMT], Australian Vanadium [ASX:AVL],TECHNOLOGY METALS AUSTRALIA [ASX:TMT], SYRAH RESOURCES [ASX:SYR], TRITON MINERALS [ASX:TON]. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

www.seekingalpha.com