The vanadium opportunity by Speculative Investors

At the present time more than 90% of the world’s production of vanadium is used in steel alloys. This particular use of vanadium could grow due to, for example, China’s government imposing new regulations requiring the use of stronger steel reinforcement bar (rebar) in concrete structures, but our interest in vanadium isn’t related to its use as a steel strengthener. Our interest stems from the possibility that the consumption of vanadium will grow rapidly over the next several years due to the increasing popularity of Vanadium Redox Batteries (VRBs).

VRBs are heavy and bulky, so they can’t be used in EVs. However, they are well suited for grid-level energy storage. This is because a) their energy capacity is only limited by the size of their storage tanks, b) they can be completely discharged for long periods with no performance degradation, c) they experience almost no capacity degeneration over time, and d) they are very stable. As further explained in the article posted HERE:

“Lithium-ion batteries are not ideally suited for grid-level energy storage because they have a short-duration and discharge run-time cycle and begin to degrade after a few hundred discharge cycles (i.e., 1,000 cycles at most). Vanadium redox flow batteries (VRBs), however, can operate for 10,000 cycles over 20 years. Vanadium batteries can also scale up while decreasing unit storage costs, whereas the unit cost of lithium batteries increases when sizing up.

The adoption of VRBs is still in its infancy with less than 500 MW (0.5 GW) of installed capacity at the global level, while the combined capacity of solar and wind energy was at 550 GW in 2016. This, according to IRENA, was up from 100 GW in 2007.

Currently, there is a lot of pent-up demand for VRBs, and this does not even count any future growth in wind and solar capacity. GTM Research and the Energy Storage Association estimate that the utility-scale energy storage market will grow to 2.6 GW by 2022 with potential to grow much larger.”

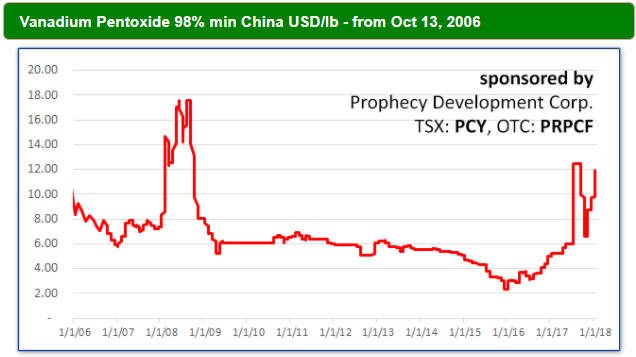

The following chart shows that vanadium pentoxide (V2O5) reached a peak of about US$18/pound in 2008 and then entered a long-term bear market that appears to have ended at $2.50/pound in early-2016. The price has since recovered to around $12/pound. The vicious upward price spike in mid-2017 was associated with concerns about declining supply in China, the world’s top producer of the commodity, but the bulk of the long-term upside potential in the vanadium price is linked to the VRB.

Chart source: http://www.vanadiumprice.com/

Listed companies that offer meaningful exposure to vanadium are few and far between. Two that we are familiar with are Energy Fuels (EFR.TO, UUUU), a current inclusion in the TSI Stocks List, and Prophecy Development Corp (PCY.TO).

EFR is not producing any vanadium at the moment, but some of its uranium projects have significant vanadium resources and its White Mesa uranium mill has a separate production circuit for the recovery of vanadium. In fact, during its long life the White Mesa mill has produced more pounds of vanadium than uranium.

EFR could quickly return to the vanadium-production business in response to a large and seemingly-sustainable increase in the price of this metal.

PCY.TO has a number of ‘irons in the fire’, including the exploration-stage Pulacayo silver-zinc project in Bolivia. However, over the past year its main focus shifted to vanadium with the acquisition (via a long-term lease) of the Gibellini project in Nevada. Gibellini has about 130M pounds of V2O5 in the M&I category and a 2011 Feasibility Study that suggests economic viability at the current V2O5 price.

With 7.5M shares outstanding, PCY’s current market cap is only C$29M (US$23M). At this time it is an illiquid stock and therefore difficult to trade in size, but it is worthy of inclusion in the Small Stocks Watch List.

Full Link(http://www.speculative-investor.com/new/weeklyrm9oao010118.html)

Disclaimer

You are receiving this message because you have specifically subscribed to our list. If you’d rather not receive emails from us, reply with subject unsubscribe. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements above do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. We have not researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of between US 1,000 to US 7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.