You Might Like Verbicom S.A. (WSE:VRB) But Do You Like Its Debt?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Investors are always looking for growth in small-cap stocks like Verbicom S.A. (WSE:VRB), with a market cap of zł19m. However, an important fact which most ignore is: how financially healthy is the business? Since VRB is loss-making right now, it’s vital to assess the current state of its operations and pathway to profitability. The following basic checks can help you get a picture of the company’s balance sheet strength. Nevertheless, these checks don’t give you a full picture, so I’d encourage you to dig deeper yourself into VRB here.

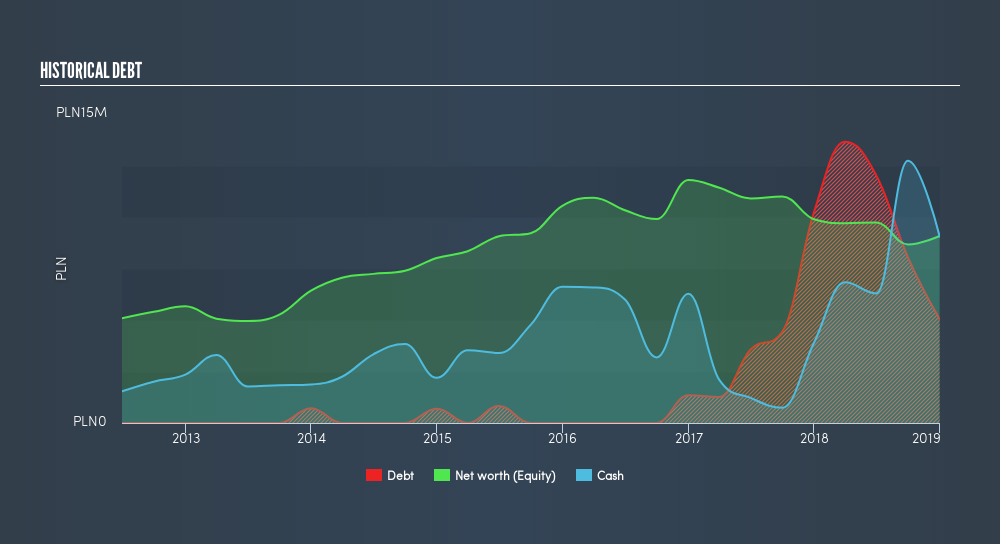

VRB’s Debt (And Cash Flows)

VRB has shrunk its total debt levels in the last twelve months, from zł10m to zł5.0m , which includes long-term debt. With this debt payback, VRB’s cash and short-term investments stands at zł9.1m , ready to be used for running the business. On top of this, VRB has generated zł149k in operating cash flow in the last twelve months, leading to an operating cash to total debt ratio of 3.0%, signalling that VRB’s current level of operating cash is not high enough to cover debt.

Does VRB’s liquid assets cover its short-term commitments?

Looking at VRB’s zł39m in current liabilities, it seems that the business has been able to meet these obligations given the level of current assets of zł46m, with a current ratio of 1.18x. The current ratio is the number you get when you divide current assets by current liabilities. For Telecom companies, this ratio is within a sensible range since there is a bit of a cash buffer without leaving too much capital in a low-return environment.

Does VRB face the risk of succumbing to its debt-load?

With a debt-to-equity ratio of 56%, VRB can be considered as an above-average leveraged company. This is somewhat unusual for small-caps companies, since lenders are often hesitant to provide attractive interest rates to less-established businesses. However, since VRB is presently unprofitable, there’s a question of sustainability of its current operations. Running high debt, while not yet making money, can be risky in unexpected downturns as liquidity may dry up, making it hard to operate.

Next Steps:

Although VRB’s debt level is towards the higher end of the spectrum, its cash flow coverage seems adequate to meet obligations which means its debt is being efficiently utilised. This may mean this is an optimal capital structure for the business, given that it is also meeting its short-term commitment. This is only a rough assessment of financial health, and I’m sure VRB has company-specific issues impacting its capital structure decisions. I recommend you continue to research Verbicom to get a more holistic view of the small-cap by looking at:

- Future Outlook: What are well-informed industry analysts predicting for VRB’s future growth? Take a look at our free research report of analyst consensus for VRB’s outlook.

- Historical Performance: What has VRB’s returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

www.simplywall.st